In a significant move within the cryptocurrency mining sector, Colorado-based Riot Platforms, a prominent Bitcoin mining company, has acquired a substantial 12% ownership stake in its competitor Bitfarms. Despite facing shorting pressure from Kerrisdale Capital, Riot Platforms proceeded with the acquisition, signaling its confidence in the strategic value of this investment.

The acquisition, disclosed in a press release on June 5th, involved Riot Platforms purchasing 1,460,278 common shares of Bitfarms at $2.45 per share, amounting to a total investment of over $3.5 million. With this transaction, Riot Platforms now holds a significant ownership position in Bitfarms, positioning itself as a key player in the cryptocurrency mining industry.

Riot Platforms has expressed its intention to leverage its newfound ownership to influence the direction of Bitfarms. It plans to call a special meeting of Bitfarms’ shareholders, aiming to nominate independent directors to the Bitfarms board. This move stems from Riot’s concerns about Bitfarms’ track record of corporate governance, highlighting the company’s commitment to driving positive change within its industry.

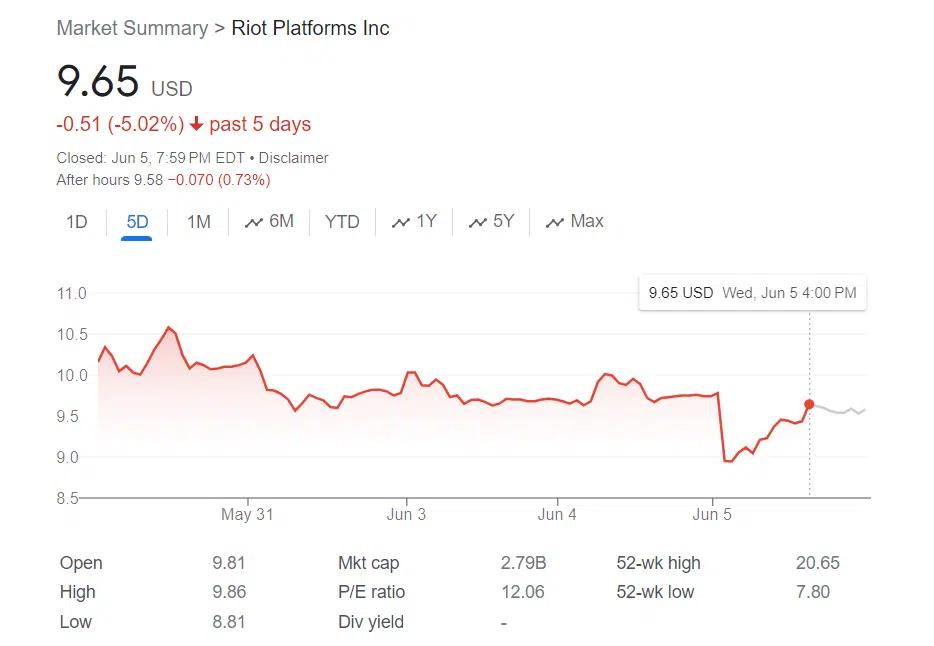

The acquisition comes amidst pressure from Kerrisdale Capital, which recently disclosed a short position in Riot Platforms, citing concerns over its equipment sourcing from China and operational issues. Despite this, Riot Platforms’ share price experienced a rebound following the announcement of its additional Bitfarms share purchase, signaling investor confidence in the company’s strategic decisions.

Earlier, Riot Platforms made headlines with a $950 million acquisition bid for Bitfarms, citing concerns about the latter’s founders’ actions and alleging that they were not acting in the best interests of all shareholders. However, Bitfarms rebuffed Riot’s proposal, asserting that it undervalued the company’s growth prospects. Bitfarms also noted that Riot did not respond to requests for customary confidentiality and non-solicitation protections, indicating a lack of alignment in their respective approaches.

Overall, Riot Platforms’ acquisition of a significant stake in Bitfarms represents a notable development in the cryptocurrency mining landscape, underscoring the ongoing evolution and competition within the industry.