Solana (SOL) finds itself at a critical juncture as it aims to recover from recent price dips and leverage resilient market indicators pointing towards potential bullish momentum.

The native token of the Solana network, SOL, experienced a significant decline to a four-week low of $145 on June 11, marking a sharp 15.8% drop within just four days. This downturn occurred amidst broader cryptocurrency market volatility, where SOL underperformed despite a 10% overall decrease in total market capitalization during the same period.

However, amidst macroeconomic uncertainties, SOL may have found a silver lining as indicated by two key factors. Investors are closely monitoring U.S. Federal Reserve signals, with expectations of potential interest rate adjustments impacting broader financial markets. Concerns over inflation data and stock market reactions have added to market jitters, potentially creating a favorable entry point for SOL investors.

Moreover, optimism persists regarding SOL’s prospects, particularly driven by speculation around a potential U.S. exchange-traded fund (ETF) listing. Despite regulatory caution towards cryptocurrencies beyond Bitcoin and Ethereum, SOL remains a strong candidate for institutional investment interest, buoyed by its real-world applications and network scalability.

Recent challenges within the Solana network, notably issues related to maximum extractable value (MEV) and manipulative practices by validators, have been addressed by the Solana Foundation. Actions to exclude harmful validators aim to restore confidence and stability within the ecosystem, crucial for long-term investor sentiment.

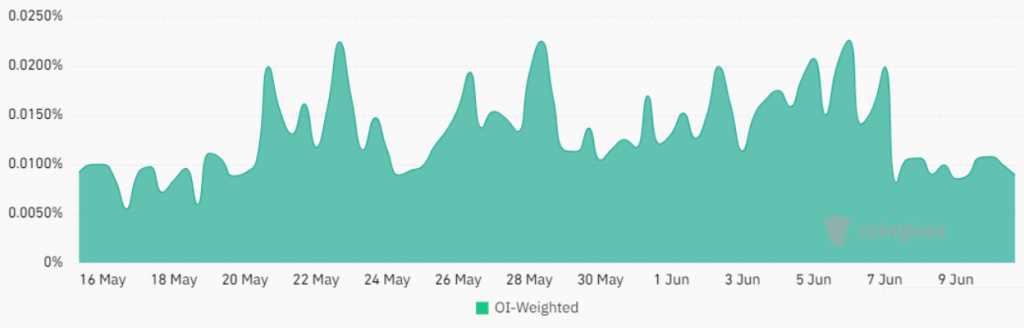

From a derivatives and on-chain metrics perspective, SOL continues to exhibit resilience. Futures markets show steady demand for leverage, with funding rates remaining stable despite recent price corrections. This stability suggests that market participants remain cautiously optimistic about SOL’s potential for recovery.

On-chain data further supports SOL’s underlying strength, with increasing user activity and transaction volumes observed across decentralized applications (DApps) like Jupiter Exchange and Raydium. While concerns over transaction fees persist, Solana’s competitive positioning relative to other blockchain platforms continues to attract attention.

Looking forward, SOL’s path to reclaiming the $170 price level appears feasible, contingent on sustained market stability and positive developments within the Solana ecosystem. As investor confidence holds firm and institutional interest potentially grows, SOL may yet see a resurgence in value, reflecting its resilience amidst volatile market conditions.

In conclusion, while SOL faces immediate challenges, its fundamental strengths and market indicators suggest a potential bullish scenario, positioning it favorably for future price recovery.