The Securities and Futures Commission (SFC) of Hong Kong has taken action against seven cryptocurrency trading platforms for operating without the necessary licenses. Here are the details:

Enforcement Action:

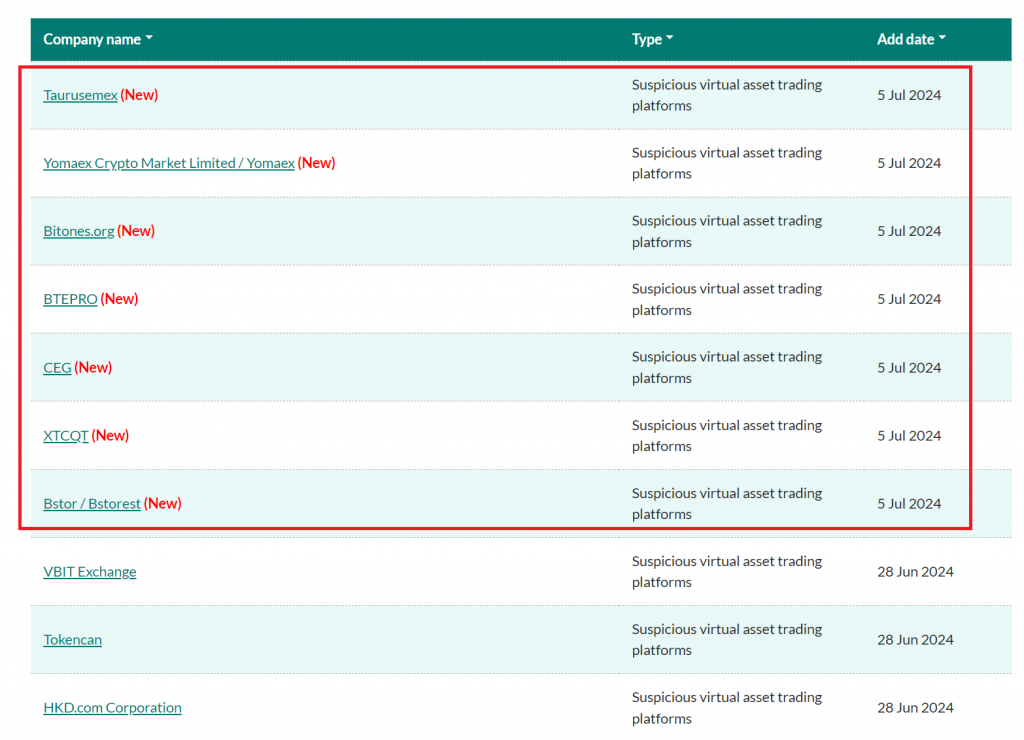

- Alert List Addition: On July 5, the Hong Kong SFC updated its Alert List to include seven crypto trading platforms: Taurusemex, Yomaex, Bitones.org, BTEPRO, CEG, XTCQT, and Bstorest. These platforms were flagged for operating illegally in Hong Kong without the required licenses.

- Investor Protection: The SFC maintains the Alert List to warn investors about platforms that are either unregistered or falsely claim association with Hong Kong regulatory bodies. This is part of efforts to protect investors from potential scams and fraudulent activities in the crypto market.

- Fraudulent Activities: The flagged exchanges are accused of engaging in fraudulent practices, including misleading investors into believing they were licensed by the SFC. Some tactics reportedly included blocking withdrawals and demanding additional fees to unfreeze accounts.

Regulatory Background:

- Regulatory Compliance Drive: Since early 2024, Hong Kong has intensified efforts to regulate crypto trading services operating within its jurisdiction. The SFC mandated that all crypto exchanges apply for licenses by May 31, 2024.

- License Application Deadline: Crypto exchanges that failed to apply for licenses by the deadline were legally required to cease operations. While initially over 22 exchanges applied, several withdrew their applications just before the deadline.

- Government Initiatives: Hong Kong authorities, including entities focused on attracting foreign investments, recently participated in a tech conference in Toronto, Canada. The aim was to promote Hong Kong as an offshore technology hub ready for Canadian crypto and Web3 startups.

- Event Details: The tech conference in Toronto was organized in partnership with the Hong Kong Economic and Trade Office, Invest Hong Kong, and StartmeupHK. It aimed to highlight Hong Kong’s appeal as a favorable destination for tech ventures amidst its regulatory framework adjustments.

The actions by the Hong Kong SFC reflect ongoing efforts to enforce regulatory compliance in the crypto sector, safeguard investor interests, and position Hong Kong as a conducive environment for digital innovation.