Bullish Signals Emerge: CryptoQuant CEO Says Bitcoin Market Is Back on Track

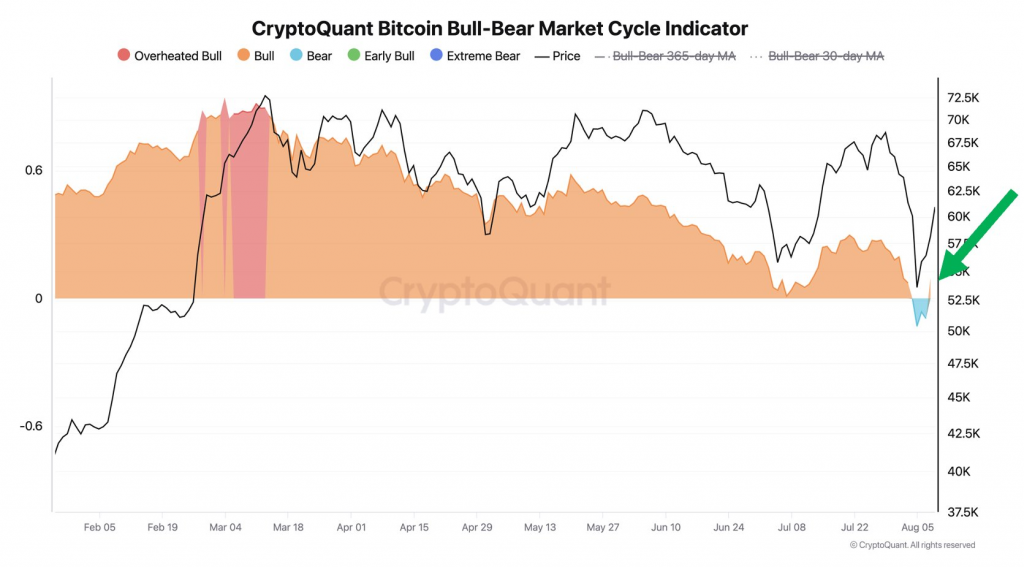

Heads up, Bitcoin fans! According to Ki Young Ju, the CEO of analytics firm CryptoQuant, the on-chain indicators suggest that Bitcoin (BTC) may be resuming its bull market. Ju has shared with his 361,000 followers on the social media platform X that CryptoQuant’s Bitcoin bull-bear market cycle indicator, which tracks shifts in investor sentiment, has flipped back to bullish after a brief dip into bear territory.

“Most Bitcoin on-chain cyclical indicators that were teetering near the edge have now swung back to signaling a bull market. BTC was only discounted for three days,” Ju tweeted.

The Bullish Case: What the Data Shows

Ju’s analysis suggests that the bull market is still very much alive. However, he has set a critical timeframe for the market to show recovery. If Bitcoin doesn’t bounce back within the next two weeks, Ju admits he might need to reassess his optimistic outlook.

“I follow the smart money. If I’m mistaken, it could mean that the new whales are either misled or have underestimated the macroeconomic environment,” Ju explained.

Adding to the bullish narrative, Ju recently highlighted that 404,448 Bitcoin had been transferred to permanent holder addresses over the past 30 days. This significant movement is seen as a clear sign of accumulation, suggesting that large players are gearing up for the long haul.

Looking Ahead: Bitcoin’s Future and Potential Regrets

Ju is optimistic about Bitcoin’s trajectory in the near future. “Within a year, we might see various entities—whether traditional finance institutions, corporations, or even governments—announce their Bitcoin acquisitions from Q3 2024,” Ju speculated.

He warns retail investors who are currently hesitating: “They might regret not buying Bitcoin now due to fears over government sales, Mt. Gox, or other macroeconomic issues.” According to Ju, those who hold off on investing may look back and wish they had acted sooner.

As we move forward, it’s clear that the Bitcoin market is stirring with renewed energy. Whether you’re a seasoned investor or a newcomer, keeping an eye on these indicators and market trends could be crucial for making informed decisions in the ever-evolving world of cryptocurrency.