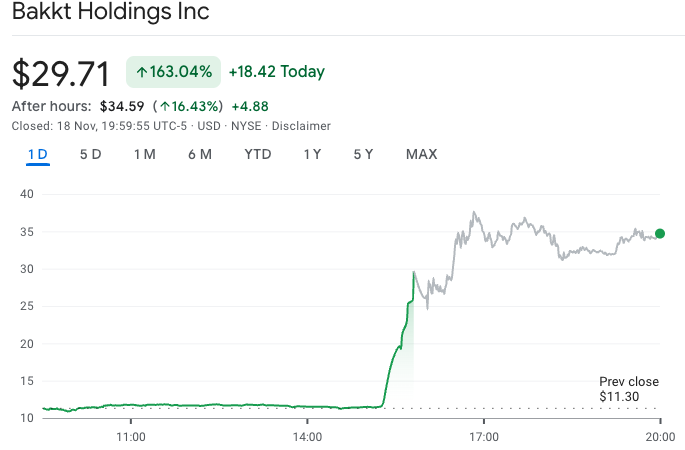

Shares of Bakkt, a crypto exchange platform, surged by an astonishing 162% on November 18 after a report emerged suggesting that Donald Trump’s media company, Trump Media and Technology Group (TMTG), is in advanced talks to acquire the struggling crypto exchange. The report, published by the Financial Times, revealed that TMTG is considering an all-share purchase of Bakkt, which is currently owned by the Intercontinental Exchange (ICE). This news caused Bakkt’s stock price to soar, closing the day at $29.71, a jump of over 162%, and continued to climb even higher after hours, reaching $34.59.

The sudden price hike didn’t just benefit Bakkt—Trump Media’s stock also saw a significant bump, rising 16.6% during regular trading. However, it did dip by about 3.5% after the market closed. The Financial Times report cited anonymous sources with knowledge of the discussions, claiming that TMTG, which owns the social media platform Truth Social and is majority-controlled by Trump himself (holding a 53% stake), is moving closer to finalizing the deal.

The crypto market has been experiencing a surge following Trump’s victory in the U.S. presidential election earlier this month, with Bitcoin alone climbing about 30%. Trump has made several promises to support the crypto industry, including reducing regulatory pressure on digital assets and potentially accumulating a strategic Bitcoin reserve. These pledges have fueled speculation that his media company could be positioning itself to become a significant player in the crypto space.

Trump’s Growing Influence in the Crypto World

If this deal goes through, it would represent another bold step by Trump into the world of cryptocurrencies. The former president has already shown interest in the sector by licensing his image for various non-fungible token (NFT) collections, as well as backing his family’s crypto venture, World Liberty Financial. Trump and his family stand to gain 75% of the project’s fees, making it clear that they are keen on profiting from the growing digital assets market.

As for the acquisition itself, the deal’s exact value remains unknown. However, following the surge in Bakkt’s stock price, the company’s valuation has shot up to over $400 million. Despite this, Bakkt has faced challenges in turning a profit and recently announced it would wind down its struggling crypto-custody business, which never fully took off. According to the Financial Times, this part of the business would not be part of the potential deal with Trump Media.

Could Trump Use Bakkt to Create a Strategic Bitcoin Reserve?

A major question surrounding this potential acquisition is whether Trump could use Bakkt as a vehicle to build a Bitcoin reserve, something he has spoken about in the past. However, this could be a complicated endeavor due to the need for congressional approval to establish a reserve of Bitcoin.

Izabella Kaminska, the founder of The Blind Spot, a finance-focused news outlet, pointed out that creating a Bitcoin reserve would likely face legal and regulatory hurdles. She suggested that Trump could circumvent these challenges by using a special purpose vehicle (SPV), a company created to isolate risk from its parent company. Kaminska speculated that Trump Media could leverage Bakkt as an SPV to buy Bitcoin without the need for congressional approval.

The idea is that Trump Media could set up a profit transfer agreement where the capital gains from Bakkt’s Bitcoin investments are donated to the U.S. government, potentially framing it as a public-private partnership. Kaminska also suggested that, under Trump’s administration, there could be an increasing trend toward privatization, making this type of arrangement more likely.

While this might sound like an unconventional strategy, it illustrates the growing interest in Bitcoin and how political figures like Trump are exploring ways to engage with the cryptocurrency space. Trump’s potential move into crypto via Bakkt could be a game-changer for the digital asset industry, but whether or not it becomes a reality remains to be seen.

What’s Next for Bakkt and Trump Media?

The road ahead for both Bakkt and Trump Media remains uncertain. If the deal does go through, it could help revitalize Bakkt, a company that has struggled to find profitability in an increasingly competitive crypto market. For Trump, the acquisition would provide a unique opportunity to further his pro-crypto agenda and tap into the growing demand for Bitcoin and other digital assets.

As the world watches to see if the deal materializes, the larger implications for both the media and crypto industries are yet to be fully realized. Will Trump be able to navigate the regulatory landscape to build a Bitcoin reserve? Could Bakkt become a key player in the cryptocurrency world under his leadership? Only time will tell, but one thing is clear: Trump is not backing down from his plans to make waves in the world of digital currencies.