Genius Group, an artificial intelligence company, has officially entered the world of Bitcoin by committing a substantial portion of its treasury reserves to the cryptocurrency. The company recently made its first move, purchasing 110 Bitcoin for $10 million at an average price of around $90,932 per Bitcoin. But this is just the beginning. Genius Group has big plans to continue buying Bitcoin, with a target of holding $120 million in the digital asset as part of its broader treasury strategy.

Roger Hamilton, the CEO of Genius Group, explained that even though they were inspired by MicroStrategy’s successful Bitcoin treasury model, they found there was no roadmap or clear guidelines for other businesses to follow. To bridge this gap, Genius Group is launching a podcast, aimed at helping other companies navigate the process of adopting Bitcoin as a treasury reserve. The podcast, set to launch on November 19, will offer practical insights on how businesses can incorporate Bitcoin into their financial strategies. Hamilton hopes that by sharing the company’s journey and experiences, other firms will be encouraged to follow suit and see the potential benefits of building their own Bitcoin treasuries.

While it’s early days for Genius Group’s Bitcoin strategy, the market has already responded with some positive movement. Following the announcement of their Bitcoin plans, the company’s stock price has seen a 22% increase over the course of the month, with shares closing at $0.91 on November 18. However, the stock is still a far cry from its all-time high of $96.80 in June 2022, which shows just how volatile the market can be for companies adopting new strategies like this.

Bitcoin’s Appeal to Firms Keeps Growing

The Bitcoin treasure hunt is on, and more companies are jumping on the bandwagon. Michael Saylor’s MicroStrategy, known for its massive Bitcoin holdings, made headlines once again on November 18 by acquiring an additional 51,780 Bitcoin worth $4.6 billion. This move boosted their total Bitcoin stash to an impressive 331,200 BTC. MicroStrategy also announced plans to raise $1.75 billion by issuing convertible notes at 0% interest, all aimed at funding further Bitcoin purchases.

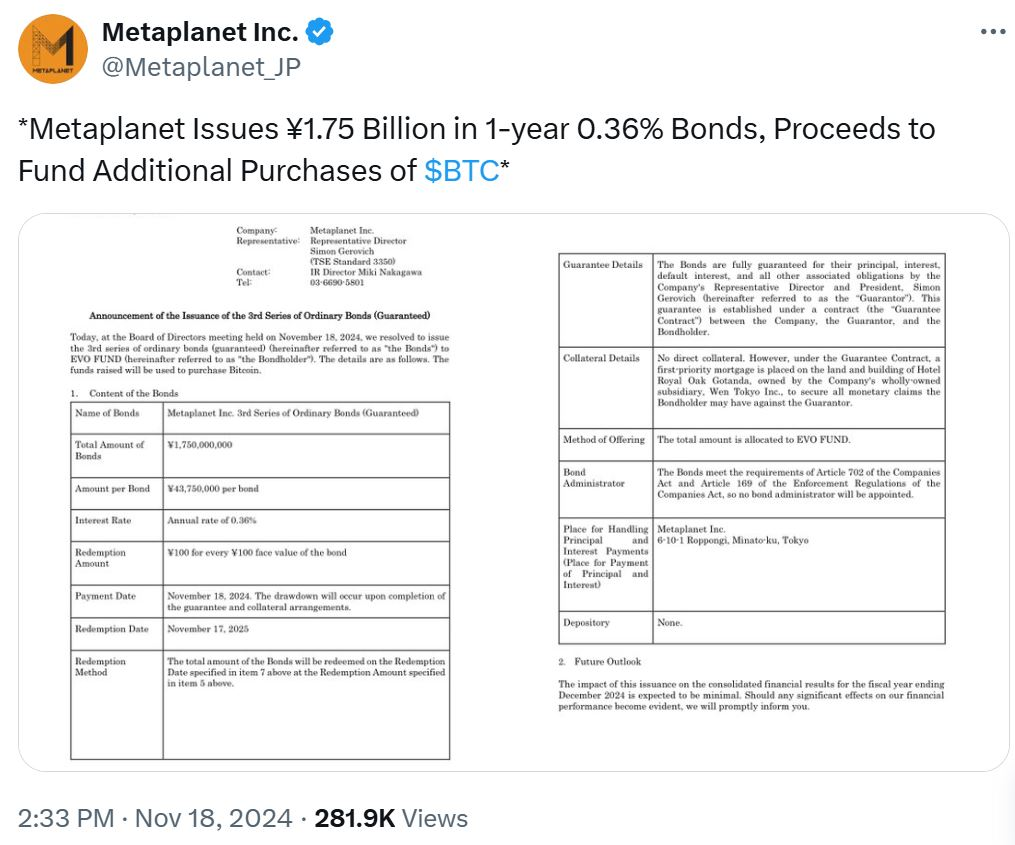

But MicroStrategy isn’t alone in this Bitcoin race. Other companies have been eyeing the potential of using Bitcoin as a reserve asset. For instance, Semler Scientific, a tech solutions provider, added 215 Bitcoin to its balance sheet in a cash deal worth $17.7 million, bringing its total holdings to 1,273 Bitcoin. Meanwhile, Metaplanet, a Japanese investment firm, is also increasing its Bitcoin holdings and plans to raise $11.3 million by issuing bonds to fund its Bitcoin strategy.

Bitcoin mining giant MARA Holdings (formerly Marathon Digital) has also embraced the trend, offering $700 million in convertible senior notes, with part of the proceeds earmarked for more Bitcoin purchases. The company intends to use the remaining funds for expansion, repaying debt, and other general business needs.

As more firms make the move to secure Bitcoin as part of their treasury reserves, the digital currency continues to gain traction as a safe-haven asset for businesses looking to protect their wealth in an increasingly uncertain financial environment.

Genius Group’s Role in Educating the Market

Genius Group is positioning itself not only as a participant in the Bitcoin revolution but also as a key educator for other businesses looking to follow in its footsteps. With the launch of its new podcast, the company is taking an active role in guiding firms through the complexities of adopting Bitcoin as a treasury asset. Hamilton’s goal is to make sure that more businesses can easily understand and implement the necessary steps to build their own Bitcoin reserves, just as Genius Group has done.

While the journey for Genius Group is still in its early stages, it’s clear that the company is making bold moves in an effort to set a new standard for corporate treasury management in the age of digital assets. As the podcast takes off and more companies consider making Bitcoin a key part of their financial strategies, the next few months could be pivotal in shaping the future of Bitcoin adoption in corporate treasuries.

The Future of Bitcoin as a Corporate Reserve Asset

The rise of Bitcoin as a treasury asset is far from a passing trend. As more companies join the ranks of those accumulating Bitcoin, the digital currency is being increasingly recognized as a store of value that can provide protection against inflation and economic instability. Whether through large companies like MicroStrategy or smaller tech firms like Genius Group, Bitcoin’s role in the corporate world is only growing. As this trend continues, we may see a fundamental shift in how companies manage their financial reserves, with Bitcoin playing an increasingly central role.

With the support of thought leaders and practical guides like Genius Group’s upcoming podcast, more companies will likely follow suit, and Bitcoin may very well become the go-to asset for businesses looking to safeguard their financial futures. The digital currency has already shown its resilience, and as adoption spreads, its role as a treasury reserve asset could become as mainstream as traditional financial instruments like stocks and bonds.