As Bitwise ventures into Solana staking with a new ETP, it’s all about rewards, low fees, and a European-first strategy while US approval still lags behind.

Bitwise, the powerhouse behind some of the most popular crypto index funds, is making waves with its launch of a Solana staking exchange-traded product (ETP) in Europe. The new product, called BSOL, offers investors an easy way to stake Solana (SOL) and earn rewards—while waiting for the green light on its Solana exchange-traded fund (ETF) in the United States.

This strategic move comes as Bitwise continues to expand its offerings in the crypto space. The BSOL ETP, which trades on the Frankfurt Stock Exchange’s Xetra trading venue, is aimed at providing European investors with a competitive way to earn staking rewards, with a 6.48% annual percentage yield (APY)—outpacing its closest competitors like 21Shares (offering 5.49%). And it’s not just about staking rewards; BSOL is designed to give exposure to Solana’s price movements, providing an all-in-one product for investors looking to capitalize on both the blockchain’s growth and its staking incentives.

Bitwise’s Competitive Edge in the European Market

Bitwise’s new ETP is set to stand out in Europe, not only due to its impressive rewards but also because of its low management fees. The 0.85% fee is significantly lower than the 2.5% fee of its main competitor, 21Shares. This low-cost structure gives BSOL a significant edge in the European market, offering an attractive product for investors looking to maximize their returns from Solana staking.

Meanwhile, in the US, Bitwise is still awaiting approval for its Solana spot ETF. The company has already filed the necessary regulatory paperwork with the US Securities and Exchange Commission (SEC), but the approval process is taking longer than expected. However, industry experts, including VanEck’s Matthew Sigel, remain bullish, with predictions that a US-approved Solana ETF could become a reality by 2025.

BSOL vs. ESOL: A Clear Staking Advantage

Back in August, Bitwise launched another Solana-related product in Europe: the ESOL ETP, which tracks Solana’s price movements. However, ESOL doesn’t provide staking rewards. Enter BSOL—which not only mirrors Solana’s price movements but also adds an additional layer of value by integrating staking rewards directly into the product. This makes BSOL a standout for investors who want to earn passive rewards while participating in Solana’s ecosystem.

As Matthew Hougan, Bitwise’s Chief Investment Officer, explained:

“Solana’s tokenomics are specifically designed to encourage staking, with the blockchain paying high rewards to stakers. BSOL lets investors participate in that opportunity with a push-button-easy ETP.”

According to Hougan, this feature—combined with BSOL’s low fees and high staking returns—positions the product to attract significant assets over time. In fact, conversations with institutional investors have revealed a growing interest in physical staking ETPs, particularly for Solana, which has become a favorite among many professional crypto investors.

Bitwise’s Big Crypto Predictions for 2025 and Beyond

Bitwise isn’t just focused on Solana. The firm has big predictions for the broader crypto market. Hougan and Ryan Rasmussen, Bitwise’s head of research, forecast that Bitcoin will surge to $200,000 or more by the end of 2025, possibly even surpassing gold’s current $18 trillion market cap by 2029. This bullish outlook for Bitcoin aligns with their broader vision of crypto as a growing asset class, with Solana and other key blockchain projects playing major roles in the future.

For Hougan, Solana’s potential as an important public blockchain is undeniable.

“Our mission at Bitwise is to help investors gain the best possible exposure to the most significant opportunities in crypto. BSOL does just that,” he concluded.

Looking Ahead: More Crypto Unicorns and ETFs

Beyond Solana, Bitwise is bullish on the future of the crypto space as a whole. The company’s recent acquisition of nine European-listed crypto ETPs has expanded its portfolio and pushed its assets under management to over $4.5 billion. ESOL, the company’s first Solana-related ETP, currently holds $24 million in assets and serves as a stepping stone toward Bitwise’s broader goals in the market.

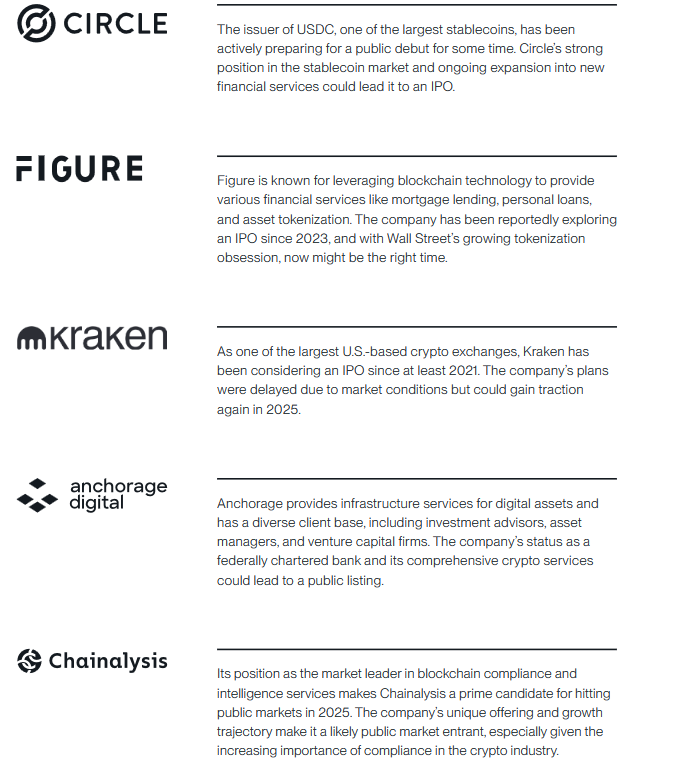

Looking to the future, Bitwise is forecasting that at least five “crypto unicorns”—including Circle (the issuer of the USDC stablecoin) and crypto exchange Kraken—will go public by 2025. Bitwise is well-positioned to capitalize on these developments, with an expanding suite of products and a growing presence in both the US and European markets.

The Bottom Line: BSOL Is Just the Beginning

Bitwise’s BSOL ETP is a major move in the world of crypto staking products, offering European investors a way to tap into the growing value of Solana with impressive rewards and low fees. As the firm awaits US regulatory approval for its Solana ETF, BSOL is positioning itself as a competitive option for those looking to stake Solana and gain exposure to its price movements.

With predictions of Bitcoin hitting $200,000 by 2025 and Solana staking continuing to attract interest, Bitwise’s commitment to providing innovative crypto products could very well pay off in the years to come. Watch this space—it’s only getting started.