As cryptocurrency mining and artificial intelligence (AI) operations surge in popularity, North America’s energy grids are facing a major stress test. From bustling mining rigs to data-hungry AI centers, the demand for electricity is reaching new, unprecedented levels. But what happens when this demand outpaces the grid’s capacity? The answer could have serious implications for power stability across the continent.

The Power Surge: Crypto & AI Lead the Charge

Cryptocurrency mining and AI technology are at the heart of North America’s evolving energy landscape. While these industries bring innovation and economic growth, they also come with hefty electricity needs that are growing rapidly. According to a report from the North American Electric Reliability Corporation (NERC), the strain on the grid is expected to increase dramatically, making it harder to predict energy demands and maintain stability.

Crypto mining is particularly unpredictable, as power consumption tends to fluctuate with market prices. In simpler terms, as cryptocurrency values rise, mining operations ramp up, sucking up more energy. This dynamic creates sudden spikes and dips in energy demand, complicating the management of the power grid.

AI, on the other hand, needs consistent and massive amounts of electricity for tasks like data processing, cooling, and storage. The result? A unique combination of fluctuating and sustained energy demand that could lead to grid instability if not managed properly.

Power Struggles Ahead: The Growing Demand

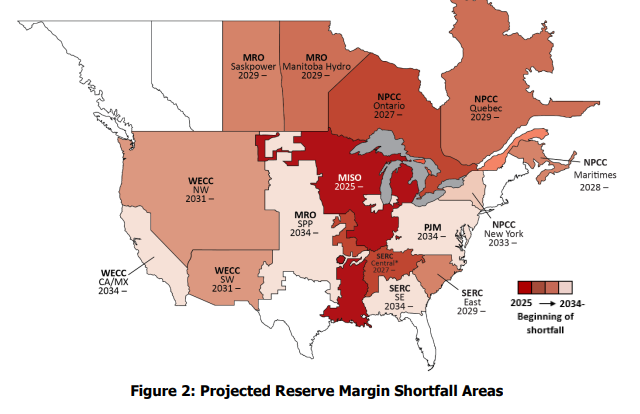

According to NERC’s Long-Term Reliability Assessment, the U.S. is on track to see a 4.6% increase in electricity demand each year, especially during peak summer months, with areas like Texas feeling the heat the most. This is four times higher than previously projected figures. The growing influence of AI and crypto mining is driving these numbers upward, with these industries consuming massive amounts of electricity.

What makes this situation even more complicated is the variable nature of energy usage in both sectors. Cryptocurrency mining operations, for instance, adjust their electricity consumption based on the volatility of crypto prices, sometimes using more power when profits are high and cutting back when prices fall. Meanwhile, AI data centers are consistently power-hungry, drawing energy for their cooling systems, servers, and storage needs, even as the demand shifts unpredictably.

The Grid Under Pressure: Risks to Stability

The rising energy consumption from crypto and AI operations is more than just a number on a report; it represents real risks to the stability of North America’s power grid. These industries’ erratic energy demands can throw off grid balance, especially during periods of peak usage or when unexpected faults occur.

Take Texas, for example—a hotspot for both AI and crypto hubs. The Electric Reliability Council of Texas (ERCOT) has reported an increase in risks tied to the fluctuating loads of these industries. Crypto mining and AI centers have unpredictable, non-contractual energy loads, which can create sudden surges or drops in electricity use. This behavior mirrors challenges faced by grid operators when managing renewable energy sources like wind and solar, which are themselves variable and weather-dependent.

The added unpredictability introduced by these sectors can mimic the challenges associated with inverter-based resources. For instance, sudden disconnections during energy price spikes or operational faults could destabilize the grid, making it harder to balance demand and supply efficiently.

Fighting Back: Strategies for Managing Energy Demands

So, how can North America’s energy infrastructure rise to meet these challenges? The answer lies in proactive planning and smarter energy management.

NERC is calling for better forecasting methods to predict the rise in electricity demand more accurately, as well as advanced transmission planning to ensure the grid can handle future loads. They’re also advocating for expanded demand-side management (DSM) programs that incentivize consumers to adjust their energy use during peak periods.

On the ground, grid operators like ERCOT are already working on solutions. Texas has rolled out energy response and demand response programs designed to balance the grid during critical times, making sure that energy is used efficiently across sectors. Additionally, Texas has passed legislation like HB 3390, which mandates improved tracking of distributed energy resources (DERs) to help with reliability assessments.

Meanwhile, some cryptocurrency miners are taking a more sustainable approach. Companies like MARA (formerly Marathon Digital) are investing in renewable energy projects, such as the acquisition of a wind farm in Hansford County, Texas. By shifting to greener energy sources, these firms are helping reduce their environmental footprint while easing the pressure on the grid.

A Glimmer of Hope

While the strain on North America’s power grid due to crypto mining and AI growth is undeniable, there are signs of progress. Industry leaders, regulators, and grid operators are working together to come up with innovative solutions to ensure that the lights stay on—literally. By improving forecasting, embracing renewable energy, and implementing smart grid management strategies, North America can handle the growing power needs of the future.

The future of energy is bright—but only if we can stay ahead of the demand.