Bitcoin’s Price Could Go Up or Down Ahead of January 29 – Here’s What Analysts Are Saying

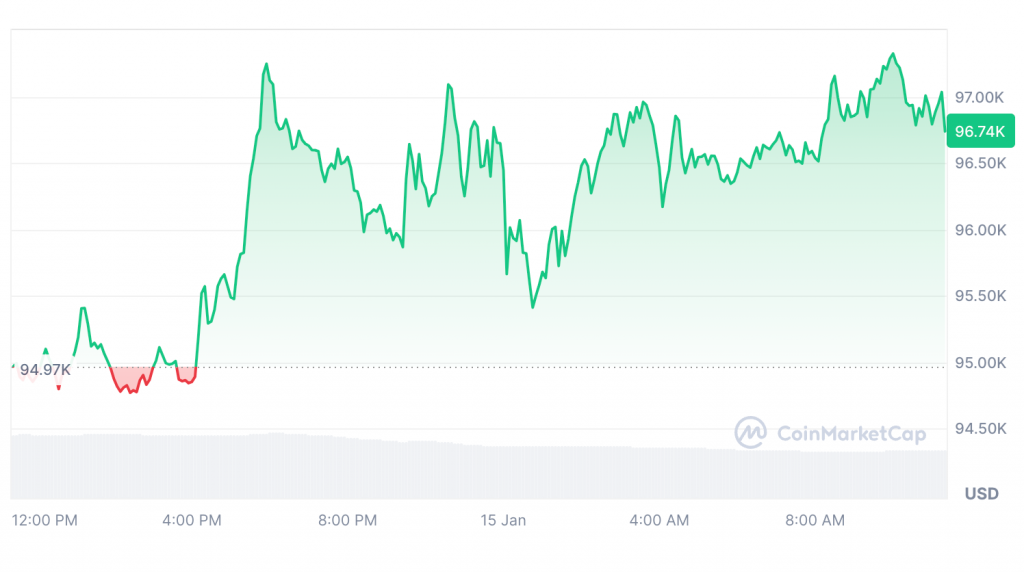

Bitcoin is in the middle of a tense price squeeze, and experts believe the cryptocurrency is gearing up for a breakout—potentially as soon as the end of January. The key trigger? The U.S. Federal Open Market Committee (FOMC) meeting on January 29. But according to crypto analyst Markus Thielen of 10x Research, this breakout could swing in either direction, with Bitcoin’s price set to either climb or drop from its current level of $96,794. The next few weeks are looking crucial, so let’s dive into why Bitcoin is at such a critical juncture and what traders should keep in mind.

Bitcoin’s ‘Narrowing Triangle’: A Squeeze Before the Breakout

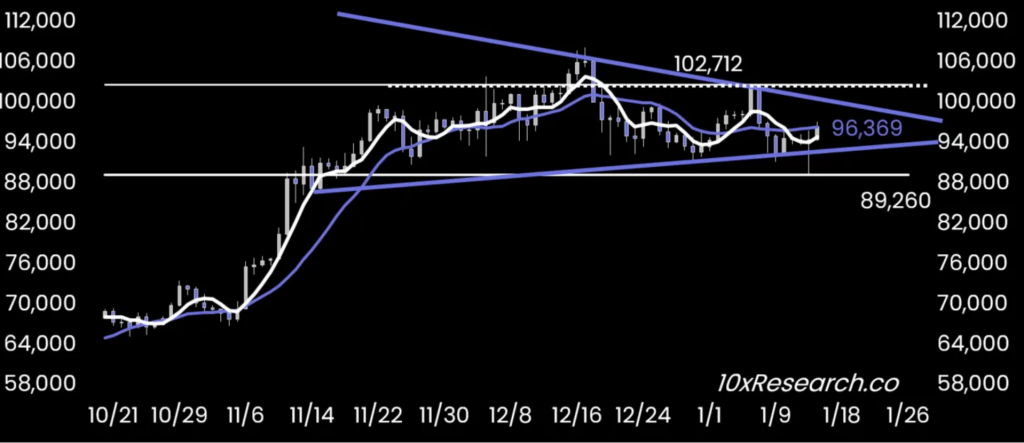

As January winds down, Bitcoin is trading within what analysts are calling a “narrowing triangle” pattern—a classic technical formation that signals a breakout is just around the corner. Thielen, who leads research at 10x, has pointed out that this formation typically leads to a sharp price movement, and it’s likely to happen by the time the FOMC meeting kicks off on January 29.

“The narrowing triangle suggests a breakout is imminent,” Thielen explained in a market report released on January 14. The big question is: which way will Bitcoin go?

Thielen isn’t offering a definitive prediction, saying Bitcoin could move either upward or downward from its current level. His advice for traders? “From a trading perspective, the best approach is to follow the breakout, regardless of direction.” That means staying on the lookout for any sharp moves, whether Bitcoin surges or dips.

Inflation Expectations and What They Mean for Bitcoin

One of the major factors influencing this potential breakout is inflation data. With rising expectations for a higher Consumer Price Index (CPI) number, Bitcoin could react strongly depending on how inflation plays out. If the inflation numbers come in cooler than expected, it could trigger a rally in Bitcoin’s price, potentially fueling a surge as investors look to hedge against a weakening dollar.

The upcoming FOMC meeting also marks the first interest rate decision of 2025, and it’s a key event for the crypto market. The Federal Reserve’s stance on interest rates has been one of the driving forces behind Bitcoin’s recent price movements. In December, the Fed’s hawkish tone raised concerns for riskier assets, like Bitcoin and other cryptocurrencies, leading to more cautious market behavior.

A Hawkish Fed and Its Impact on Risk Assets

In its latest report, Bitfinex pointed to the Federal Reserve’s December statement as one of the most hawkish stances in recent months, suggesting that interest rate cuts might be fewer than initially expected in 2025. This has sparked concern among traders, as tighter monetary policy typically spells trouble for risk assets like Bitcoin.

In particular, Fed Chair Jerome Powell’s December remarks indicated that the Fed could take a more cautious approach to rate cuts in the coming year, which could dampen investor sentiment in riskier markets like crypto. According to the CME FedWatch Tool, there is a 38.3% probability that the Fed will hold off on any rate cuts during the first half of 2025, further adding to the uncertainty around Bitcoin’s short-term price direction.

Caution Ahead: Bitcoin’s Range-Bound Future and Trump’s Inauguration

Despite the potential for a breakout, Thielen remains cautious about Bitcoin’s near-term future, especially as Donald Trump’s U.S. presidential inauguration approaches on January 20. He suggests that Bitcoin may struggle to gain momentum in the weeks following the inauguration and could enter a consolidation phase, remaining range-bound until mid-March.

“Due to weak market drivers, Bitcoin will likely remain range-bound until mid-March,” Thielen noted, signaling a period of sideways movement where Bitcoin’s price doesn’t make any dramatic moves in either direction. This could be a sign of market indecision or a lack of fresh catalysts to drive significant price action.

Bitcoin’s Election Cycle: History Repeating Itself?

Interestingly, crypto analyst Lark Davis pointed out that Bitcoin’s current price action is eerily similar to what happened during the last presidential election cycle. In a January 14 post on X (formerly Twitter), Davis highlighted a striking parallel between Bitcoin’s performance before the 2021 inauguration of President Joe Biden and its current behavior leading up to Trump’s second term.

Looking back at 2021, Bitcoin experienced a dip toward the $30,000 mark just before Biden’s inauguration, only to rebound sharply to around $55,000 after the event. While Davis acknowledged that “history may not repeat itself, it often rhymes,” this comparison has sparked some speculation that Bitcoin could follow a similar pattern in the wake of Trump’s inauguration later this month.

If Bitcoin does follow the same trajectory, it could mean a short-term dip followed by a strong recovery, but this is by no means guaranteed. Still, for traders and investors, the historical pattern offers some food for thought when considering how Bitcoin may behave in the coming weeks.

The Bottom Line: Bitcoin at a Crossroads

With January winding down and the January 29 FOMC meeting drawing closer, Bitcoin is at a crucial crossroads. Whether the cryptocurrency will break upward or downward is still anyone’s guess, but the narrowing triangle pattern suggests that a sharp price move is imminent.

For traders, the key takeaway is to be prepared for volatility, as the breakout could happen at any moment. Bitcoin’s fate may depend on inflation data, the Fed’s decision on interest rates, and the broader macroeconomic environment. While some analysts, like Thielen, remain cautious in the short term, others, like Davis, see potential for Bitcoin to repeat the price action of past election cycles.

As always with Bitcoin, anything is possible. But one thing is clear: the coming weeks will be critical for the world’s leading cryptocurrency, and traders will need to stay alert to ride the wave, whichever direction it goes.

What’s Next?

Keep an eye on the FOMC meeting and the latest inflation data, as these could be the key factors that decide Bitcoin’s next big move. With a potential breakout on the horizon, there’s a lot of excitement in the air—but also plenty of uncertainty. Stay tuned!