The World’s Richest Man Faces Legal Heat for Delayed Twitter Stake Disclosure – Here’s What You Need to Know

In an unexpected twist of events, the U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against none other than Elon Musk, claiming the billionaire failed to disclose his significant stake in Twitter (now X) on time in 2022. This legal move could cost Musk big, as the SEC alleges that his delay allowed him to buy shares at artificially low prices, resulting in a $150 million benefit at the expense of Twitter investors. But Musk, as usual, isn’t backing down – here’s the story in all its dramatic detail.

A Late Disclosure? The SEC Thinks So

It’s no secret that Elon Musk isn’t afraid of making waves, but the SEC’s latest move has definitely created a legal splash. The federal agency claims that Musk violated U.S. securities laws by not disclosing his ownership of over 5% of Twitter’s stock on time.

According to a filing made by the SEC on January 14, 2022, Musk began buying shares of the social media giant early in the year. By March 14, he had acquired more than 5% of Twitter’s total outstanding shares, making him a key shareholder. However, the SEC argues that Musk didn’t file the required public report until April 4, 2022—11 days after the legal deadline to disclose his ownership.

The SEC argues that this delay gave Musk a significant edge. By not revealing his growing stake, he was allegedly able to keep purchasing additional shares at “artificially low prices” before the market could react to the news of his ownership. The commission claims that this oversight ultimately allowed Musk to purchase shares at a discounted rate, effectively “underpaying by at least $150 million” for the stock he acquired after the deadline had passed.

Musk’s Big Twitter Takeover and the Price Hike

On April 4, 2022, when Musk’s stock purchase news finally hit the market, Twitter’s stock price surged by a whopping 27% in one day. The timing was suspicious, especially considering Musk’s late disclosure. The SEC alleges that the delayed report meant the market didn’t have the full picture, giving Musk the opportunity to snap up even more shares at bargain prices.

To make things even more dramatic, Musk’s legal battles and high-profile purchases weren’t exactly a surprise at this point. Just weeks later, on April 25, Musk officially bought Twitter for a jaw-dropping $44 billion and took the company private. The move sparked headlines across the globe, but it’s the SEC’s focus on the timing of his stock buys that has Musk in hot water now.

Elon Responds: A Broken System?

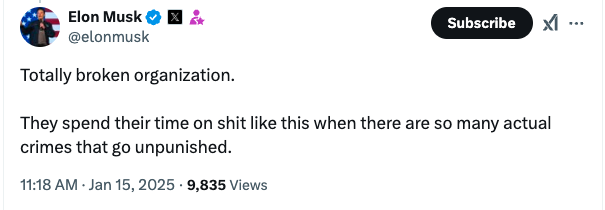

Of course, Musk wasn’t about to take the SEC’s accusations lying down. On January 15, the tech mogul took to X (formerly Twitter) to slam the SEC, calling the organization a “totally broken” institution. According to Musk, the SEC spends way too much time on trivial matters like this lawsuit, while far more serious crimes go unpunished.

Musk’s legal team, led by attorney Alex Spiro, didn’t mince words either. Spiro described the SEC’s actions as a “multi-year campaign of harassment” against his client, arguing that the lawsuit is “a sham” with no real basis. Musk, he added, has “done nothing wrong,” and the legal move is simply an attempt by the SEC to make a case out of nothing.

Spiro also made it clear that the SEC’s decision to pursue a “single-count” lawsuit shows they have no real case to make. “Today’s action is an admission by the SEC that they cannot bring an actual case,” he said. For Musk, it seems like business as usual – always pushing back against the system, no matter the odds.

The Bigger Picture: Twitter, X, and Musk’s Regulatory Scrutiny

Musk’s tumultuous acquisition of Twitter, which he later rebranded as X, has brought a new wave of regulatory challenges. Since taking over, Musk has fired top executives, slashed the workforce, and made dramatic changes to content moderation policies. These moves, alongside the platform’s shift under Musk’s leadership, have put X under intense scrutiny in multiple regions, including Europe and Australia.

But despite the controversy surrounding his management of X, Musk’s focus remains firmly on the legal challenges at hand, including the SEC’s lawsuit. The agency is now asking for a jury trial, hoping to force Musk to pay “disgorgement of his unjust enrichment,” meaning he could be required to give back the $150 million in alleged overpayments from his stock purchases. In addition to that, Musk may also face a hefty civil penalty.

What’s Next? The Clock Is Ticking

The SEC’s move comes at a critical time. On January 20, SEC Chairman Gary Gensler is set to step down, leaving behind a leadership shift at the commission. As it happens, Musk himself is set to advise the incoming administration on government efficiency, potentially adding an extra layer of intrigue to the case.

With the SEC now formally seeking a jury trial, Musk’s legal team will undoubtedly go full throttle to defend their client. Whether the lawsuit results in any penalties for Musk or not, one thing is certain: this is far from over. And, of course, Elon Musk will continue to make headlines no matter the outcome.

Stay tuned, because this story is far from finished. The SEC has thrown down the gauntlet, but Musk is gearing up for the next round.

In Conclusion: A Case of Timing and Money

At the heart of the SEC’s lawsuit is the allegation that Musk’s delay in disclosing his Twitter ownership allowed him to score millions in undervalued stock. The case raises questions about the fairness of stock purchases, market transparency, and whether Musk truly benefited from his late disclosures. As the battle continues, both Musk and the SEC are positioning themselves for what promises to be a legal showdown that could set significant precedents for future securities law cases. Keep watching, because this one’s far from over!