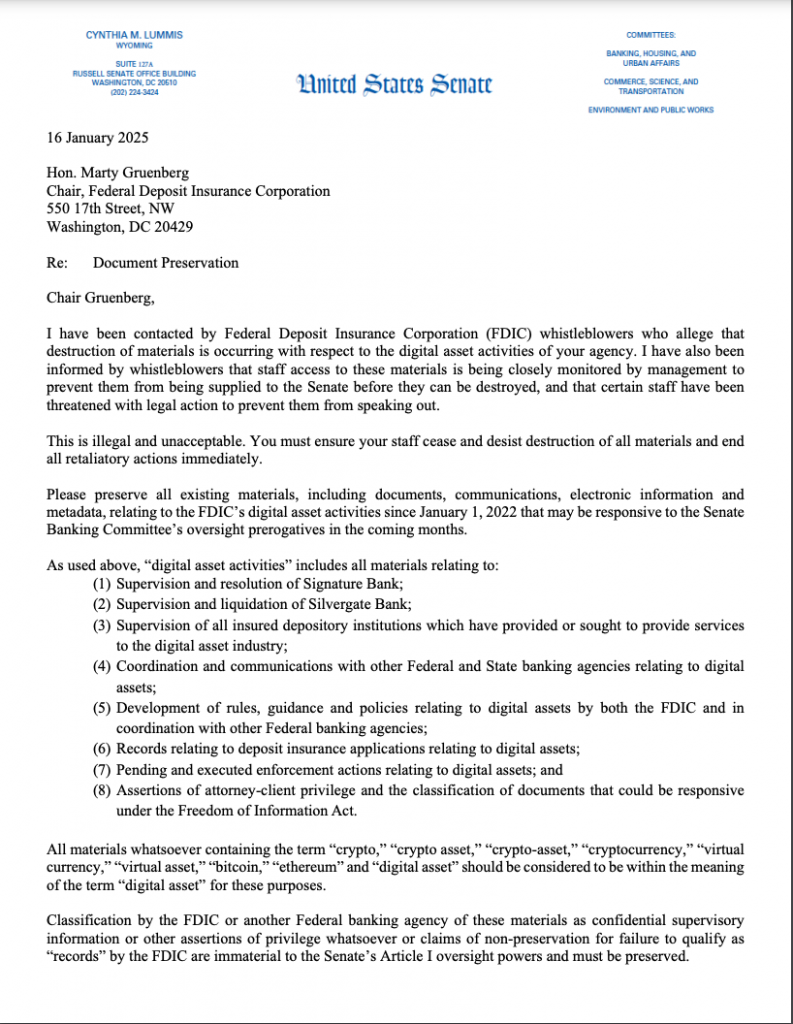

In a bold move, Wyoming Senator Cynthia Lummis has sent a letter to the Federal Deposit Insurance Corporation (FDIC) accusing the agency of destroying critical documents tied to the controversial Operation Chokepoint 2.0. The senator claims that whistleblowers have provided evidence suggesting that the FDIC intentionally shredded records related to the government’s campaign against cryptocurrency firms and their banking access.

Lummis is now demanding that the FDIC cease its document destruction and preserve all records connected to the oversight of crypto-related activities. This includes key files about the supervision of Signature Bank and the liquidation of Silvergate Bank, two financial institutions deeply involved with the cryptocurrency sector.

The senator issued a stern warning in her letter, saying:

“If it is uncovered that you or your staff have knowingly destroyed materials or sought to obstruct the oversight functions of the Senate, I will make swift criminal referrals to the US Department of Justice.”

Operation Chokepoint 2.0: The Alleged Government Campaign Against Crypto

The accusations from Senator Lummis center on Operation Chokepoint 2.0, a term used by some critics to describe a coordinated effort by federal agencies to cut off banking services to companies involved with digital assets, including cryptocurrency businesses. While not officially acknowledged as an operation, the campaign allegedly impacted crypto-related firms in the U.S. and abroad, causing widespread disruption.

The core of the operation appears to have been a push to limit crypto companies’ access to traditional banking services by pressuring banks to restrict or sever ties with crypto firms. The efforts sparked backlash from industry leaders, with many arguing that this was a form of financial targeting meant to stifle the growth of the crypto sector.

The controversy surrounding the operation has also become a significant political issue in the lead-up to the 2024 U.S. elections, with advocacy groups and lawmakers rallying to protect the interests of the burgeoning digital asset industry.

Crypto Industry Leaders React: Fighting Back Against Debanking

The allegations of document destruction have come amid growing unrest within the cryptocurrency community. After Marc Andreessen, co-founder of venture capital firm Andreessen Horowitz, appeared on The Joe Rogan Experience to discuss the broader implications of Operation Chokepoint 2.0, more than 30 crypto founders took to social media to share their experiences of being debanked—a process where their access to traditional banking services was stripped away by financial institutions, often under pressure from federal agencies.

Notable voices included Sam Kazemian, the founder of Frax Finance, and Brian Armstrong, the CEO of Coinbase, one of the world’s largest crypto exchanges. These executives are not just speaking out against the practice—they’re actively seeking transparency and accountability from the FDIC.

Armstrong, for example, filed a Freedom of Information Act (FOIA) request to obtain letters the FDIC allegedly sent in 2022 urging banks to pause or reduce their crypto-related activities. When Armstrong received the heavily redacted versions of the letters, he didn’t back down. He pressed for full transparency, demanding the release of the unredacted documents to better understand the nature of the government’s involvement in this debanking effort.

Court Ruling: FDIC’s Redactions Deemed Unlawful

In a significant legal development, Judge Ana Reyes ordered the FDIC to release more transparent documents after finding that the agency’s blanket redactions were unjustified. On December 12, Judge Reyes wrote that the FDIC could not simply “blanket redact everything that is not an article or preposition,” calling the redactions a “lack of good-faith effort” to comply with the spirit of transparency under the FOIA.

This court ruling was a significant blow to the FDIC’s attempt to limit access to critical records, and it has further fueled concerns within the crypto industry about the government’s role in limiting the sector’s ability to function.

Crypto Firms Adapt to Survive Amid the Pressure

Despite the mounting regulatory pressure, the crypto industry has shown resilience. Many firms, forced out of traditional banking channels, found new ways to continue their operations. One of the major shifts was a significant pivot to stablecoins, a class of cryptocurrency assets pegged to traditional fiat currencies, particularly the U.S. dollar.

In the wake of losing business accounts at major banks, crypto firms turned to stablecoins as a way to finance operations, conduct transactions, and manage liquidity. The use of stablecoins provided a workaround for crypto companies, allowing them to avoid the banking system that had increasingly restricted their access.

The ability of the crypto sector to adapt to these challenges speaks volumes about its flexibility and innovative spirit, even in the face of a tough regulatory environment. However, the ongoing legal battles and political discourse signal that the fight for crypto’s place within the broader financial system is far from over.

Looking Ahead: What’s Next for Crypto and the FDIC?

As the investigation into the alleged document destruction unfolds, the question remains: will the FDIC be held accountable for its actions, and what will be the broader implications for the crypto industry?

If Senator Lummis’ claims are proven true, the fallout could be significant, not just for the FDIC but for the entire regulatory framework surrounding the crypto market. The future of Operation Chokepoint 2.0 and its potential for continued interference with crypto firms depends heavily on the results of these ongoing investigations and the political pressure from both sides of the aisle.

For now, it seems the crypto community is determined to continue pushing for transparency, fair treatment, and accountability as they seek to carve out a space in the global financial landscape. With influential figures like Lummis and Armstrong leading the charge, the battle over crypto’s role in the U.S. economy is far from settled.