The cryptocurrency space isn’t just for tech geeks and financial gurus anymore. A new survey from on-chain analytics firm CryptoQuant sheds light on the demographic of crypto investors, revealing that young, well-educated, and savvy investors are making up the bulk of the market. And while the space is still overwhelmingly male, there are some pretty interesting trends emerging that give us a closer look at who’s driving the industry forward.

Age is Just a Number (But Most Are Between 25 and 44)

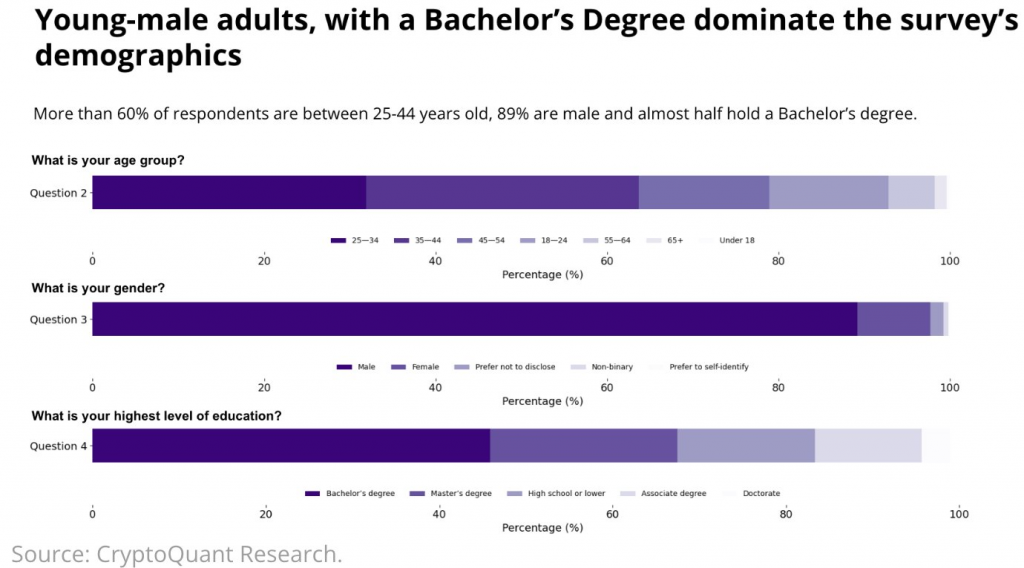

Who’s actually investing in crypto? According to CryptoQuant’s January 2024 survey, over 60% of investors are between the ages of 25 and 44. To break it down further: 35% are in the 25-34 range, and 26% fall into the 35-44 group. These aren’t the “get rich quick” crowd—these investors are strategic and often have the education and experience to back up their decisions.

Educated, Savvy, and Always Learning

Crypto might still feel like a wild west for many, but a large number of investors are highly educated. Nearly half of respondents hold a bachelor’s degree, and 28% have gone the extra mile with an advanced degree. This suggests that crypto isn’t just a playground for the tech-obsessed; it’s a space for well-informed decision-makers who know how to do their homework.

A Space for Retail Investors

While crypto has often been seen as a market dominated by whales and institutional investors, the retail investor is clearly still in charge. Most of the respondents reported investing less than $10,000 annually. This indicates that many of the people making up the crypto community are smaller, individual investors rather than big institutions throwing around millions.

A Male-Dominated Market—For Now

Like much of tech, the crypto space remains heavily male. Around 89% of respondents identify as men, with only 11% identifying as women. However, the space is evolving, and with more women entering tech and finance, we may see this demographic shift over time.

Asia is Still the Leader, but Europe and North America are Growing

Asia is leading the charge when it comes to crypto adoption, with 40% of respondents hailing from the continent. Europe follows with 29%, while North America accounts for just 10%. While the U.S. and Canada have seen a significant increase in crypto usage, Asia’s dominance in crypto trading platforms is clear.

Where Do Investors Turn for Advice?

When it comes to making investment decisions, most investors are going solo. 22% rely on their own research, proving that many are taking a DIY approach to their investments. However, 16% of investors do turn to social media influencers or key opinion leaders (KOLs) for insights. Surprisingly, recommendations from friends, family, or even the media play a much smaller role in decision-making.

Spot Trading is King—But Staking Is Gaining Ground

The world of crypto trading is still dominated by spot trading, with a whopping 76% of respondents choosing it over more complex methods like derivatives or staking. However, staking and yield farming are on the rise, with 28% of investors engaging in these earn products. This shows that while the crypto market is still rooted in trading, more investors are looking for ways to make their digital assets work for them.

Binance: The Undisputed Champion

When it comes to exchanges, Binance reigns supreme. A staggering 53% of survey respondents say it’s their primary platform of choice. Not only is it the most popular, but it’s also the most profitable—51% of users report making their largest gains through Binance. Nearly half of respondents (48%) store the bulk of their assets on the exchange, solidifying its position as the go-to platform for traders worldwide.

However, it’s not the only player in town. Platforms like Bybit, OKX, and Bitget are favored by full-time traders, while Coinbase and Kraken are preferred by part-time investors. Regionally, Binance dominates in Asia, Africa, and South America, with usage rates surpassing 50% in these areas. Coinbase is the top choice in North America, with 45% of respondents using it as their main exchange.

Compliance Matters: Investors Are Watching Closely

A fascinating finding from the survey was that a significant chunk of investors are paying attention to exchanges with regulatory issues. 83% of participants monitor or avoid exchanges that are involved in regulatory issues. This makes Binance (rated most compliant by 32% of users) and Coinbase (rated second by 14%) stand out as trusted platforms for traders who care about staying on the right side of the law.

Bitcoin & Layer-2s Still Lead the Charge

When it comes to the most popular cryptocurrencies, the results are predictable—Bitcoin remains the undisputed king. But it’s not just Bitcoin leading the charge. Ethereum, layer-2 scaling solutions, and DeFi projects (Decentralized Finance) are also capturing investor attention.

Bitcoin is the number one choice for profit generation, with 18% of respondents saying it’s their top pick, followed by Ether, Solana, and XRP. As CryptoQuant points out, the focus on well-established, high-cap cryptocurrencies shows that investors are playing it safe, sticking with projects that have proven their stability and potential.

Conclusion: Crypto is More Than Just a Trend

The data from CryptoQuant’s 2024 survey paints a clear picture of the cryptocurrency space as a market driven by young, educated, and informed investors. While the market is still evolving and there are plenty of opportunities for growth, it’s clear that crypto’s future isn’t just about tech enthusiasts or “early adopters.” It’s about a broadening demographic that’s actively shaping the industry. From spot trading to staking, and with Binance standing tall as the go-to exchange, the crypto world is evolving—and it’s exciting to see where it goes next.