The $36 Trillion Debt Ceiling and Bitcoin’s Price: What’s at Stake?

As the US government approaches its $36 trillion debt ceiling, a major financial event could spell a short-term shakeup for Bitcoin. With global liquidity tightening in the wake of the debt ceiling suspension, Bitcoin’s price could experience a correction before continuing its upward momentum into 2025. But fear not, crypto enthusiasts—this is likely just a temporary dip on the way to even greater heights.

What’s Happening with the US Debt Ceiling?

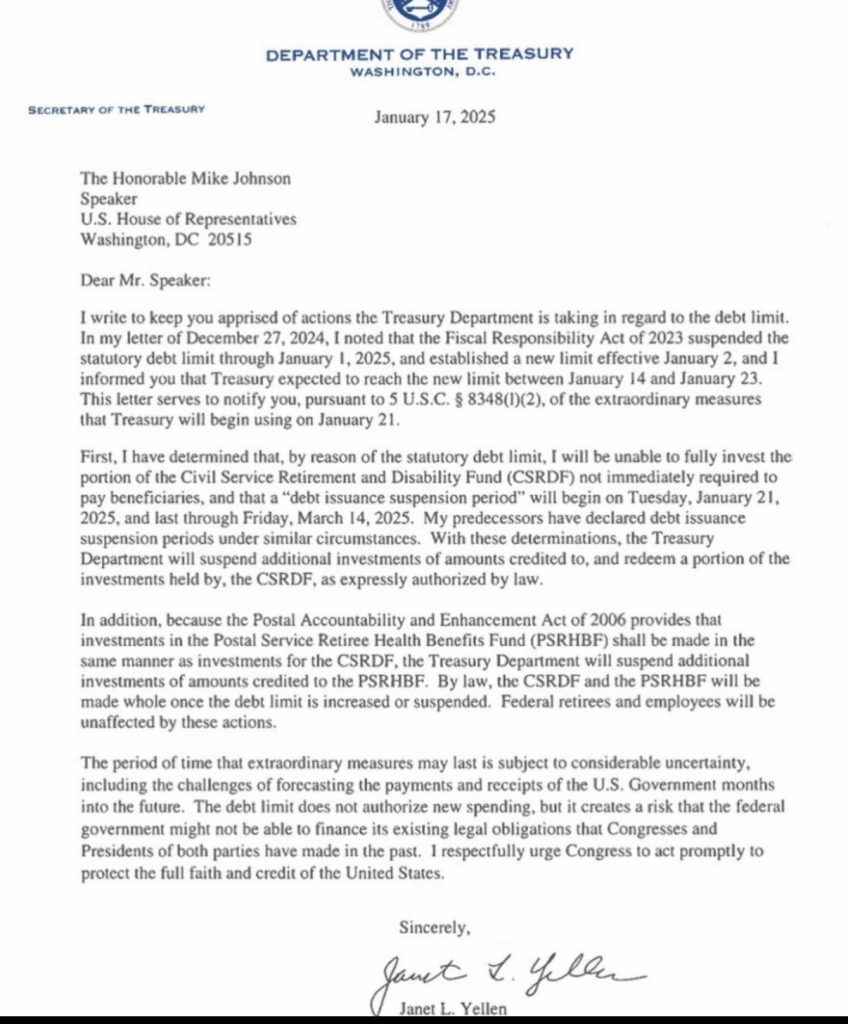

On January 20, just a day after President-elect Donald Trump takes office, the US Treasury is expected to hit its $36 trillion debt ceiling, forcing it to enter what’s called a “debt issuance suspension period.” Treasury Secretary Janet Yellen announced that this suspension will begin on January 21 and last until March 14, according to a letter published on January 17.

This nearly two-month pause in debt issuance could signal a significant decrease in global liquidity, which may impact Bitcoin’s price in the short term. Despite Bitcoin hitting an all-time high of over $109,000 on January 20, analysts are predicting that Bitcoin could experience a pullback to around $70,000 before climbing higher later in the year. It’s all part of a natural market cycle—one that’s influenced by the ebb and flow of global liquidity.

Bitcoin’s Short-Term Correction: What to Expect

Raoul Pal, founder of Global Macro Investor, suggests that Bitcoin is approaching a “local top” in January 2025, with the price likely to peak around $110,000. This would be followed by a correction due to the “interim peak in liquidity,” which could see Bitcoin’s price dip below $70,000 by February.

The reasoning behind this? Bitcoin has a strong correlation with the global liquidity index. When liquidity tightens, as it is expected to during the debt issuance suspension period, Bitcoin’s price often takes a hit. However, this correction should be temporary, with a potential rebound once global liquidity starts to rise again.

How Will Institutional Investors React?

Not all analysts are overly concerned about the debt ceiling’s impact on Bitcoin. Some see the current situation as a mixed bag for the cryptocurrency. According to Marcin Kazmierczak, co-founder and COO of Redstone, while traditional markets will likely feel the effects of tighter liquidity, Bitcoin might act as a hedge against the financial instability triggered by the debt ceiling crisis.

Kazmierczak points out that during past debt ceiling stand-offs, Bitcoin’s price has shown mixed correlations with traditional markets, sometimes even decoupling from stock market movements. If Bitcoin gains a reputation as a safe haven asset amidst global uncertainty, investors may flock to it as a store of value, cushioning the downside risks.

Alvin Kan, COO of Bitget Wallet, added that volatility in traditional markets could spill over into crypto markets. If investor sentiment turns negative across the board, Bitcoin could suffer along with traditional assets. However, the key factors will be investor reactions, global economic policies, and overall financial sentiment—factors that are notoriously hard to predict.

The Bright Side: A Promising Future for Bitcoin Post-March

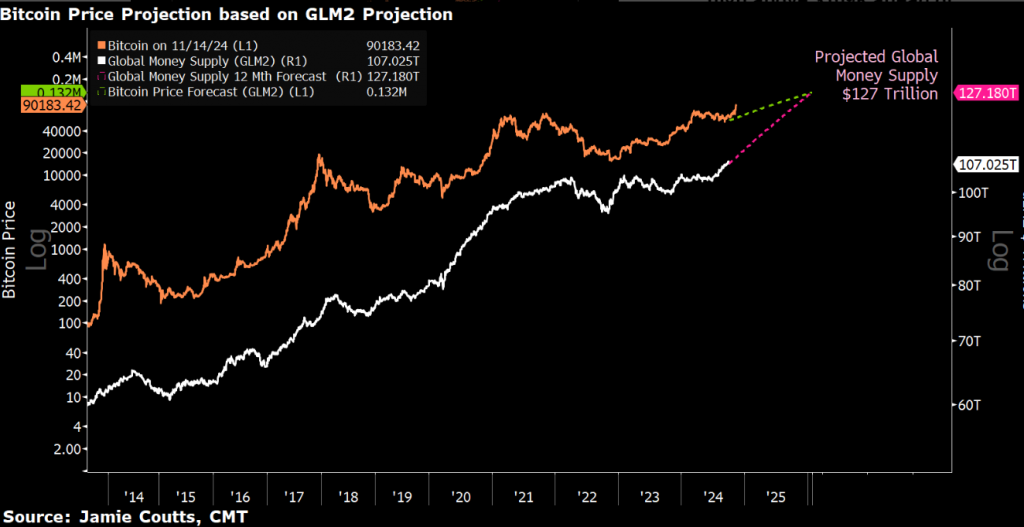

After March 14, global liquidity is expected to rise again, signaling a bullish trend for Bitcoin in the latter half of 2025. According to Jamie Coutts, chief crypto analyst at Real Vision, the global M2 money supply—an estimate of all cash and short-term deposits in the economy—should peak on January 26, 2026. As money supply increases, Bitcoin could benefit from higher liquidity and stronger demand, with the possibility of pushing Bitcoin’s price above $132,000 by the end of 2025.

This potential surge is backed by more than just liquidity trends. Asset management giant VanEck has made even more aggressive predictions, estimating that Bitcoin could reach $180,000 by late 2025, following a potential 30% retracement in the first quarter of the year.

Bitcoin’s Long-Term Prospects: A New Era for Crypto?

While the immediate future may involve some volatility, the long-term outlook for Bitcoin remains incredibly positive. The combination of rising global liquidity, increasing institutional adoption, and Bitcoin’s growing role as a hedge against financial instability could propel the cryptocurrency to new heights.

For investors, this means that short-term dips are simply buying opportunities for those willing to ride the waves of global financial trends. As Bitcoin continues to mature as an asset class, it’s likely to play an even more significant role in global markets—especially as governments grapple with mounting debt and inflationary pressures.

So, while the US debt ceiling presents a potential bump in the road, it’s clear that Bitcoin’s journey is far from over. With a strong foundation, increasing adoption, and macroeconomic factors aligning in its favor, the cryptocurrency could see some incredible gains by the end of 2025 and beyond.

Conclusion: Hold Tight, the Best is Yet to Come

In the world of cryptocurrency, volatility is part of the game. The US debt ceiling may trigger a short-term correction, but Bitcoin’s long-term trajectory remains strong. As liquidity improves after March, and with increasing global demand for alternative assets, Bitcoin’s price could easily soar above $132,000, if not higher.

For those invested in Bitcoin, this is just another chapter in a story that’s only beginning to unfold. Buckle up—2025 could be the year that Bitcoin truly breaks through into the mainstream.