A $20 Billion Crypto Shake-Up That No One Expected (Except Maybe the CCP)

It looks like China’s been busy. The Chinese government has reportedly sold off nearly $20 billion worth of Bitcoin—more than 194,000 BTC—that it had seized from the notorious PlusToken Ponzi scheme. This massive sell-off, likely taking place in the weeks leading up to January 23, has raised eyebrows across the crypto world. But before you panic, let’s dig into why Bitcoin’s price seems to have shrugged it off.

The Great Bitcoin Dump: China’s Crypto Fire Sale

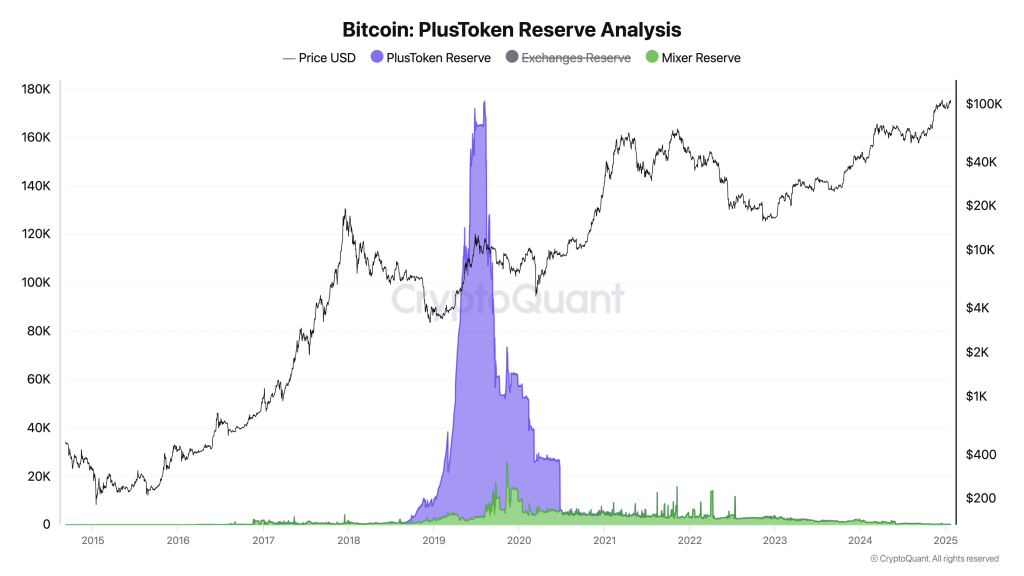

According to Ki Young Ju, CEO of blockchain analytics platform CryptoQuant, China has quietly offloaded a jaw-dropping stash of Bitcoin. In a post on X (formerly Twitter) on January 23, Ju revealed that over $19.7 billion worth of BTC had been sold. This Bitcoin wasn’t some random stash—it was seized from PlusToken, a massive Ponzi scheme that collapsed back in 2019. At that time, Chinese authorities hauled in over $4.2 billion in crypto, and the confiscated Bitcoin had just been sitting in the country’s national treasury.

Ju speculates that the Chinese government likely sent the Bitcoin to major cryptocurrency exchanges, including Huobi, to carry out the sell-off. And here’s the kicker—Ju adds that it’s hard to imagine a regime like China’s holding onto something as “censorship-resistant” as Bitcoin. He suggests, with a hint of sarcasm, “A censored regime holding censorship-resistant money feels unlikely.” Uh, yeah, we’re not so sure about that either.

Bitcoin’s Price: Shrugging Off $20B in Sales Like a Boss

You’d think a $20 billion Bitcoin dump would make the market lose its mind, but Bitcoin is holding strong. Despite the sell-off, Bitcoin stayed above $101,000 on January 23, much to the surprise of crypto analysts. However, it did experience a bit of a dip, falling more than 3.7% in the 24-hour period leading up to 12:22 AM UTC. But let’s be real—Bitcoin’s volatility is kind of its thing.

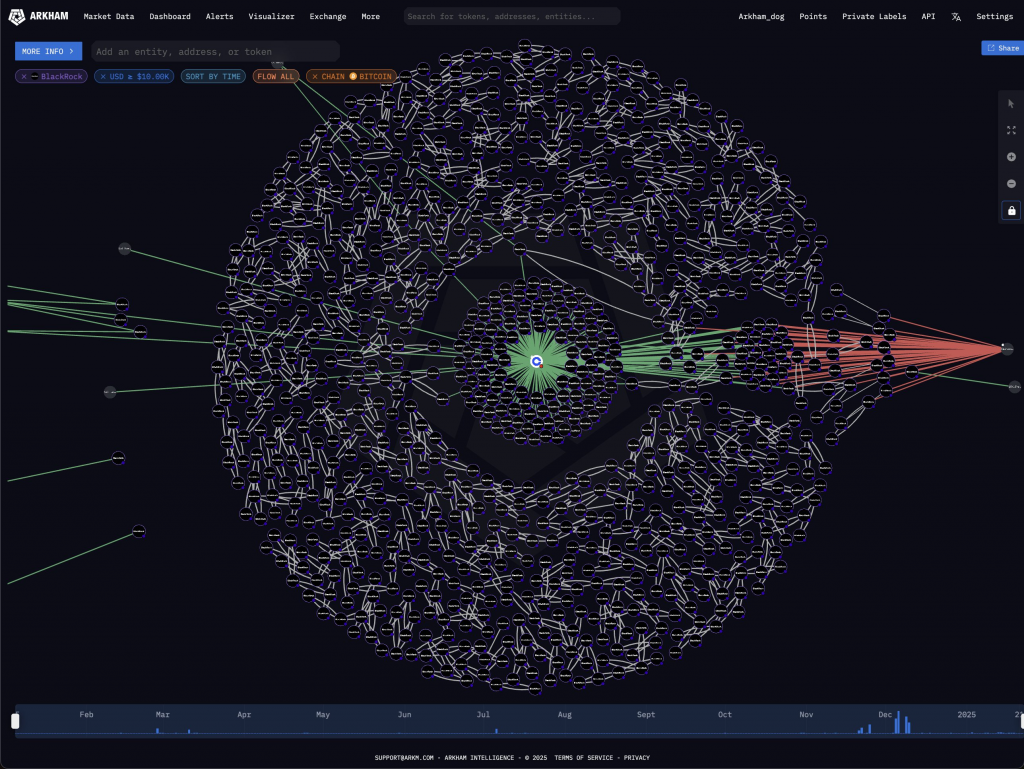

So, how is Bitcoin managing to stay afloat after such a massive sell-off? Part of the reason lies in the continued support from institutional investors—especially from heavyweight players like BlackRock. The asset management giant has been on a Bitcoin-buying spree, picking up the cryptocurrency for five consecutive days. And on January 21, BlackRock made its biggest Bitcoin purchase of the year, buying up a cool $600 million worth of BTC. Talk about a vote of confidence!

Is Bitcoin Really This Resilient? Let’s Talk About the Bigger Picture

So, what’s really going on here? Bitcoin might have dodged a bullet with China’s massive sale, but there’s more at play in the market than just institutional buying. Economic factors, particularly those tied to global interest rates, could be keeping Bitcoin on edge. Ryan Lee, Chief Analyst at Bitget Research, suggests that concerns over tighter monetary policy could continue to weigh down on Bitcoin’s price in the short term.

Lee points to the recent dip in Bitcoin’s price and the looming fears of global interest rate hikes, which have created a bit of bearish sentiment. But here’s the silver lining: institutional buying—especially from heavy-hitters like BlackRock and World Liberty Finance—could help stabilize prices and keep Bitcoin from falling off a cliff.

Markets are now eagerly eyeing June 18, the date the US Federal Reserve might announce the next interest rate cut. According to CME Group’s FedWatch tool, the expectation is that the US central bank could start easing up on rates, which would likely provide a boost to risk assets like Bitcoin.

The Takeaway: Is Bitcoin Really Bulletproof?

It seems like Bitcoin has proven its resilience once again. Despite a massive sell-off from China and the ongoing uncertainty surrounding interest rates and global monetary policy, Bitcoin’s price has managed to hold steady, supported by continued institutional demand.

But if you’re hoping for a smooth ride, think again. The crypto market is as volatile as ever, and it wouldn’t be surprising to see more ups and downs as the global economic situation evolves.

At the end of the day, though, Bitcoin is still here, defying expectations—and that’s what makes it so fascinating.