Bitcoin Takes a Dip: Is the Bull Run Over?

Bitcoin’s price took a surprising tumble on January 27, 2025, dropping 7% to $97,754, marking the first time in over 10 days that it fell below $98,000. As markets digested the latest tech development—a China-based ChatGPT competitor called DeepSeek—traders were left scratching their heads, wondering if Bitcoin’s bullish momentum had finally hit a wall.

The drop raises a key question: Has Bitcoin’s wild ride towards $100K hit a snag, or is this just a temporary setback in a longer-term bull run?

What’s Behind the Dip? DeepSeek’s AI Challenge & Global Tension

Despite the dip, the Bitcoin derivatives market wasn’t showing signs of panic. On the surface, it looked like whales and institutional players were prepared for this kind of correction. But the real story might lie deeper in the global macro picture, particularly with China’s DeepSeek AI announcement, which sent ripples through both crypto and tech markets.

You might be wondering: What does AI have to do with Bitcoin? While Bitcoin has historically had a low correlation with tech stocks, the DeepSeek launch sparked a broader global sell-off, particularly in AI stocks, raising fears of a slowdown in global economic growth. As investors trimmed their risk exposure, crypto, often seen as a risk asset, felt the heat.

Stable But Not Too Bullish: Bitcoin Derivatives Show Resilience

Even as Bitcoin price dipped, its futures and options markets showed a different story. For one, the futures premium—a key metric for understanding market sentiment—remained above 10% despite the correction. This suggests that traders weren’t panicking and weren’t rushing to short the market (betting that prices would fall). Instead, the market appeared to be in a holding pattern, waiting to see what would happen next.

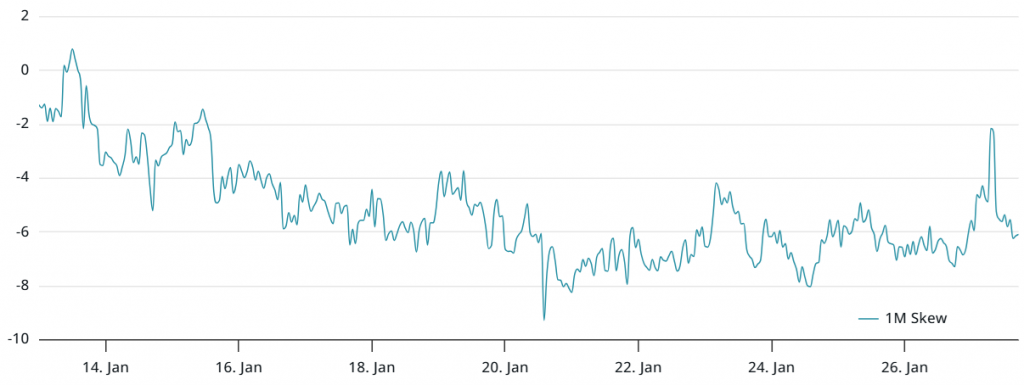

The Bitcoin options skew—which shows the difference in demand for call (buy) vs. put (sell) options—remained pretty stable too. In normal conditions, a 25% delta skew sits between -6% and +6%, with values on the more negative side signaling bullish sentiment. While the skew briefly shifted from -7% to -2%, indicating some slight bearish leanings, it quickly corrected back to -6%, signaling that professional traders weren’t overly concerned about the dip.

In short, while Bitcoin may have slipped below $98K, the market remains resilient, and there’s no massive rush to hedge against further downside… yet.

China’s Market Still Lukewarm on Crypto

The Chinese market, often a bellwether for global crypto sentiment, has shown signs of moderate selling pressure. How? USD Tether (USDT), the most widely used stablecoin, has been trading at a 0.7% discount to the official USD/CNY exchange rate—an indication that traders aren’t rushing to buy crypto. This is a slight improvement compared to the 1.5% discount seen earlier, but it still reflects weak demand in the region.

However, it’s important to note that this trend has been going on since January 19, just after Bitcoin made its attempt to reclaim the $105,000 mark. So, while demand in China may not be firing on all cylinders, it hasn’t completely crashed either.

Macro Woes and the Global Economic Slowdown

Another reason for the drop? It’s hard to ignore the global economic slowdown. With stock markets in shaky territory and a general sense of uncertainty, investors are pulling back from riskier assets—Bitcoin included. The DeepSeek AI launch added to the turbulence by stoking fears in the tech sector, especially after a slump in AI stocks on December 27, triggered by competition from the Chinese firm.

Now, Bitcoin has historically had a low correlation with stocks and traditional markets, but the rising uncertainty across the board is leading traders to reduce risk exposure. And when that happens, it’s not just stocks that take a hit—crypto often follows suit.

What Does This Mean for Bitcoin?

For long-term Bitcoin investors, the outlook remains somewhat “half full.” There’s still a belief that Bitcoin will eventually come out on top as a scarce asset—especially as central banks keep printing money and inflation looms. However, in the short term, it looks like Bitcoin’s price hitting a new all-time high anytime soon might be a bit of a stretch.

With Bitcoin still facing resistance around the $100K mark and the broader market uncertainty weighing on sentiment, it’s anyone’s guess where things go next. But one thing is for sure: Bitcoin’s volatility is far from over.