Arbitrum’s blockchain just got a major upgrade! A sleek, institutional-grade boost is now live, thanks to Spiko, a French fintech company. The buzz? Spiko has deployed a whopping $150 million in tokenized money market funds, including US and EU T-Bills, onto Arbitrum One. For anyone keeping tabs on the growing world of Real-World Asset (RWA) tokenization, this is BIG news. But what does this actually mean for the future of crypto and traditional finance? Let’s break it down.

Spiko Brings the Big Guns to Arbitrum

Spiko isn’t just dipping its toes into the world of blockchain—it’s making a serious splash. The company has now added its tokenized money market funds to Arbitrum One, offering a new way to access high-quality, low-risk assets directly on the blockchain. These aren’t your run-of-the-mill crypto tokens. Spiko’s tokenized US and EU Treasury Bills (T-Bills) are regulated under UCITS, a European framework for mutual funds, making them an institutional-grade investment.

So, what’s the deal with these funds? Well, they give investors an easy way to trade money market assets on a blockchain, which is a pretty big deal. You’re essentially getting the stability of T-Bills, but with the speed and flexibility of the Arbitrum network. If you’re into crypto and want to play it safe with your assets—without missing out on blockchain perks—this could be a game-changer.

Spiko’s US & EU T-Bills Funds: What’s Happening?

Let’s dive into the numbers:

- Spiko’s US T-Bill Money Market Fund has been performing pretty well, with its net assets growing by 8% in just 30 days. The fund now holds over $50 million in assets, offering an annual percentage yield (APY) of 4.37%. Not bad for a stable, government-backed asset, right?

- Spiko’s EU T-Bill Fund is making even bigger waves, with total assets of $95.1 million, growing by a solid 10.9% over the past month.

These aren’t just random funds either; they’re tied to the backbone of stable, traditional finance—the U.S. and EU governments. So, this isn’t your average crypto pump-and-dump—this is tokenized stability with a blockchain twist.

Tokenized US Treasuries: The Future Is Now

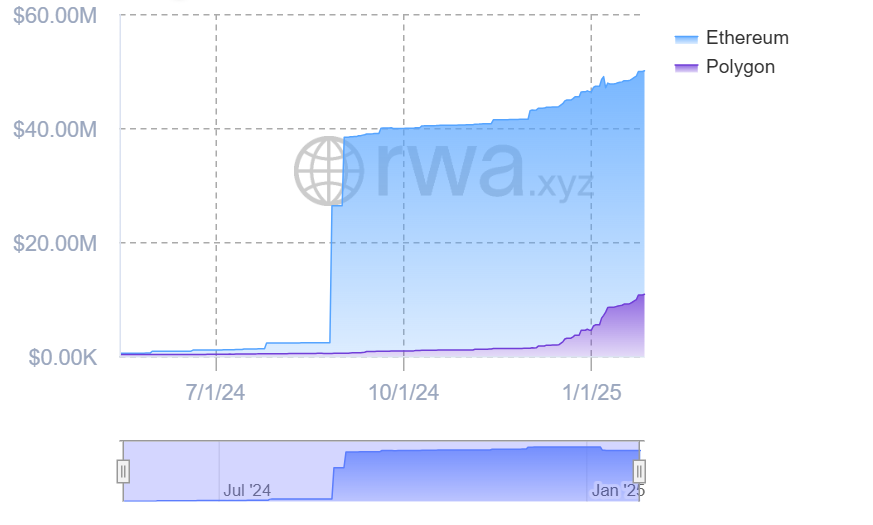

Now, it’s not just Spiko jumping on the tokenized US Treasury bandwagon. Other players are getting in on the action, too. For example, Ondo Finance announced on January 28th that it’s deploying its Short-Term US Government Treasuries (OUSG) on the XRP Ledger. Tokenized Treasury assets are growing fast, with the combined value of such assets currently standing at a cool $3.43 billion, according to RWA.xyz.

So, why is this important? Tokenized Treasury assets are essentially bridging the gap between traditional finance and crypto. In the past, trading something like US Treasuries was confined to high-net-worth individuals and institutional investors, but with tokenization, these kinds of assets are now accessible to a much broader range of people. And that’s just the beginning!

The Future of RWA Tokenization: Could Politics Play a Role?

Here’s where things get extra interesting. Could the political landscape be shaping the future of RWA tokenization? According to Eli Cohen, an attorney working with Centrifuge, the Trump administration might be more crypto-friendly than you think. Cohen believes that a new wave of pro-crypto policies could be on the horizon, opening the door for more participation in RWA markets. This could lead to easier banking and brokerage access for the creation of even more tokenized products.

So, a new administration could really change the game. Think about it—if traditional financial institutions can work alongside blockchain platforms to create tokenized assets, the floodgates could open for even more mainstream adoption of crypto. It’s all about getting the right legal frameworks in place.

When Will Mainstream Finance Jump on the RWA Tokenization Bandwagon?

As exciting as all this is, RWA tokenization is still in its early days. But don’t expect it to stay that way for long. Jesse Knutson, Head of Operations at Bitfinex Securities, thinks that the future of RWA tokenization will ultimately be driven by traditional financial players—specifically, nimble institutions like family offices.

“These fast-moving institutions are going to have an outsized impact in the early days,” he said, adding that tokenization’s clear benefits will eventually attract mainstream institutional investors. In short, it’s all part of the larger trend of merging the old-school finance world with the new-school blockchain one.

So, What Does This All Mean?

To wrap it up, Spiko’s move to bring $150M in tokenized T-Bills to Arbitrum One is a big step forward for both blockchain and traditional finance. It signals that the world of Real-World Assets is gaining momentum, and crypto could become the bridge between stable, regulated financial products and the exciting, fast-paced world of decentralized finance.

As tokenization continues to grow, expect more players to enter the field, and more institutional money to follow. Whether it’s Spiko or other companies, the future of finance is looking increasingly blockchain-based—and that could change the game for investors everywhere.