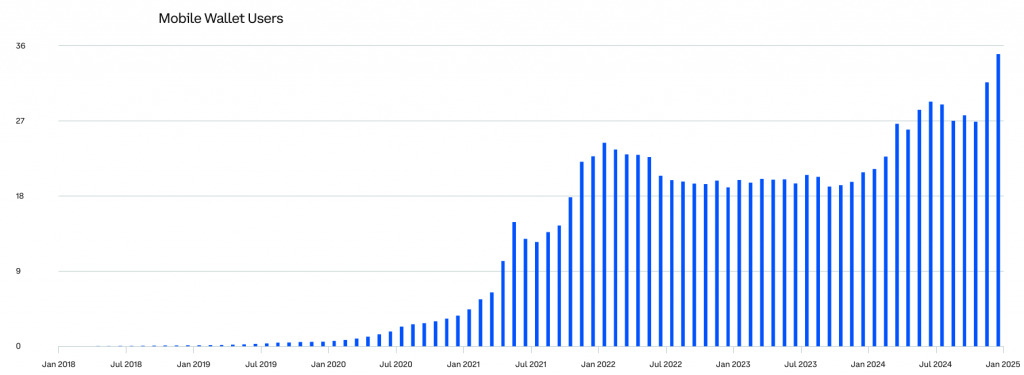

The world of cryptocurrency is buzzing with excitement as mobile wallets reach a record-breaking 36 million users. With more and more passive crypto holders turning into active users, it’s clear that the digital asset revolution is well underway.

A Big Jump: 36 Million Active Wallets

In Q4 2024, the number of active mobile cryptocurrency wallet users hit a historic high of over 36 million, according to Coinbase’s latest quarterly crypto market update. This marks a significant milestone, showing that crypto is no longer just a niche interest for early adopters—it’s becoming mainstream.

Daren Matsuoka, data scientist at a16z Crypto, points out that mobile wallets are playing a crucial role in transforming passive crypto owners into hands-on users. What does that mean exactly? Well, while owning cryptocurrency is one thing, actually engaging with decentralized finance (DeFi) or other blockchain-based apps is what officially turns someone into an active user.

And when you compare this number—36 million active wallets—to the staggering 560 million global crypto holders reported by the 2024 Cryptocurrency Ownership report from Triple-A, it’s clear that the potential for growth is massive.

More Crypto Users Are on the Horizon

Pavlo Denysiuk, CEO of crypto payment platform Lunu, predicts that the number of crypto holders could triple over the next two years. If user growth continues at its current pace, the crypto landscape will look much different in the near future, with many more people getting involved, not just as investors but as everyday users of blockchain technology.

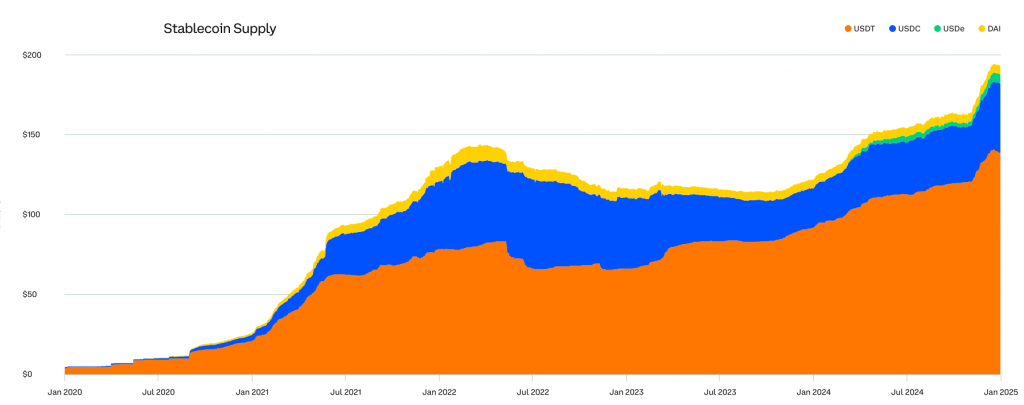

Stablecoins: The New “Killer App” of Crypto

One of the hottest trends in crypto right now? Stablecoins. These digital assets are quickly becoming the go-to solution for making crypto transactions faster, cheaper, and more accessible for everyone.

In fact, stablecoins were dubbed crypto’s “killer app” in 2024. As crypto’s liquidity increases and the use of digital assets for payments and cross-border transactions grows, stablecoins are increasingly seen as a powerful tool. Their main draw? They offer a way to transfer value quickly and at a lower cost compared to traditional financial systems.

In Q4 2024 alone, the total supply of stablecoins surged by over 18%, nearly touching the $200 billion mark. That’s a serious uptick in demand, signaling that more people and businesses are seeing stablecoins as the bridge between traditional money and the crypto world.

Stablecoin Trading Volume Hits $30 Trillion

When you look at the volume of trading, the numbers are staggering. Stablecoin trading volume saw a more-than-threefold increase to $30 trillion in 2024, with over $5 trillion of that occurring in December alone, thanks in part to Bitcoin’s record-breaking surge to $100,000.

This massive increase in trading volume is a sign of just how much confidence investors are placing in stablecoins. On November 21, 2024, stablecoin inflows to crypto exchanges hit a record $9.7 billion in a single month. Just a few weeks later, Bitcoin’s price would cross the $100K milestone, solidifying crypto’s growing influence.

The Road to Wider Adoption: Stablecoins as the Future of Finance

Looking ahead, stablecoins are poised for even broader adoption—especially in areas like remittances, digital capital markets, and financial services for those without access to traditional banking. But as much potential as they have, clearer regulations will be crucial to unlock stablecoins’ full promise and drive financial inclusion across the globe.

According to Coinbase’s report, “The stage has now been set for broader adoption of stablecoins” in these key areas. If regulations can keep pace with innovation, stablecoins could soon become an essential tool for anyone looking to send money across borders, access financial services, or simply hedge against inflation.

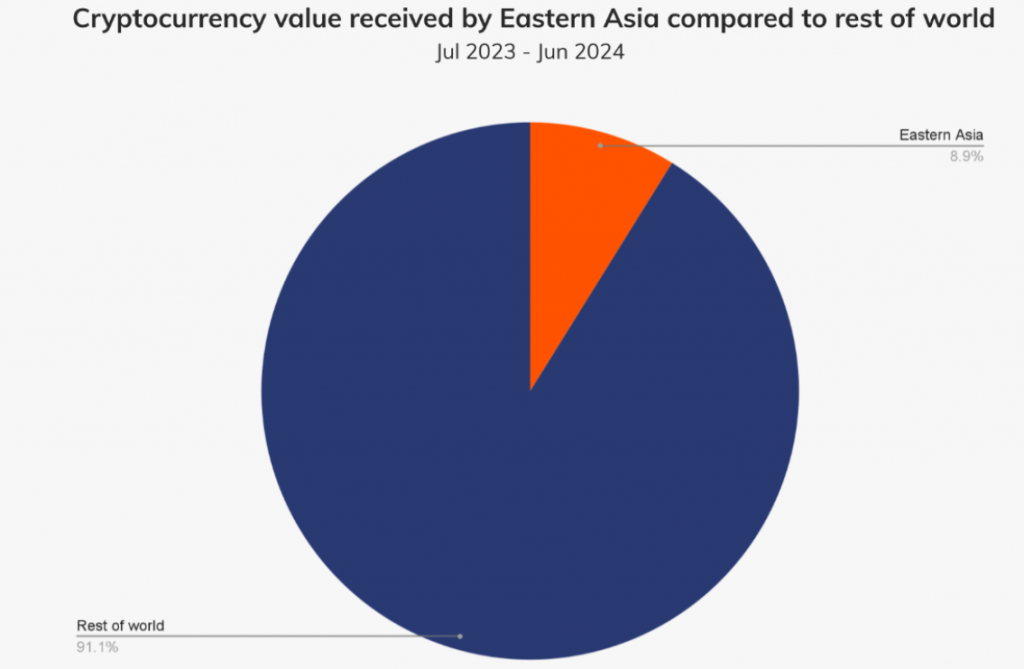

Crypto and Stablecoins Gaining Ground in East Asia

Perhaps one of the most exciting developments is the rise of stablecoins in East Asia. In several countries in this region, stablecoins are slowly replacing traditional fiat currencies, driven by their ability to offer cheaper, faster alternatives to traditional banking systems.

East Asia has emerged as the world’s sixth-largest crypto economy in 2024, accounting for over 8.9% of global crypto value received from June 2024 to July 2023, according to Chainalysis. The region’s growing adoption of crypto and stablecoins is fueled by issues like fiat currency devaluation and high inflation rates in some countries.

Maruf Yusupov, co-founder of Deenar, a stablecoin backed by physical gold, suggests that stablecoins are offering a much-needed solution in emerging markets. “In most emerging markets, stablecoins are gradually replacing fiat because they come with lower barriers to entry, lower costs, and are easier to use. If this trend continues, we could see a decline in the reliance on traditional banking systems,” Yusupov says.

This trend is particularly evident in the remittance market, where sending money across borders through banks can be expensive—fees average around 7.34% for bank account transfers, according to Statista. With stablecoins, people can bypass these hefty fees, making it a win-win for users and businesses alike.

East Asia: A Growing Crypto Powerhouse

Between June 2024 and July 2023, East Asia saw over $400 billion in on-chain crypto value flow into the region. This highlights just how crucial crypto adoption is becoming in global markets, especially as crypto offers more stability and ease than traditional financial systems.

As the adoption of digital assets continues to grow globally, East Asia is quickly positioning itself as a key player in the crypto economy. And with stablecoins leading the way, this shift could change the financial landscape forever.