A Memecoin Mishap: Ross Ulbricht’s Wallets Lose Big in Crypto Slip-Up

In the world of cryptocurrency, where fortunes can rise and fall in the blink of an eye, a simple mistake can lead to massive losses. That’s exactly what happened with wallets tied to Ross Ulbricht, the creator of the infamous Silk Road marketplace, who was recently pardoned by President Donald Trump. According to blockchain analytics firm Arkham Intelligence, these wallets lost a staggering $12 million after an unfortunate trading blunder involving a fan-made memecoin called ROSS.

So, what went wrong? It all comes down to a mistake made while trying to provide liquidity on the decentralized exchange (DEX) Raydium, which led to a bot swooping in and grabbing millions in a matter of seconds.

The Liquidity Pool Fiasco: How It All Unfolded

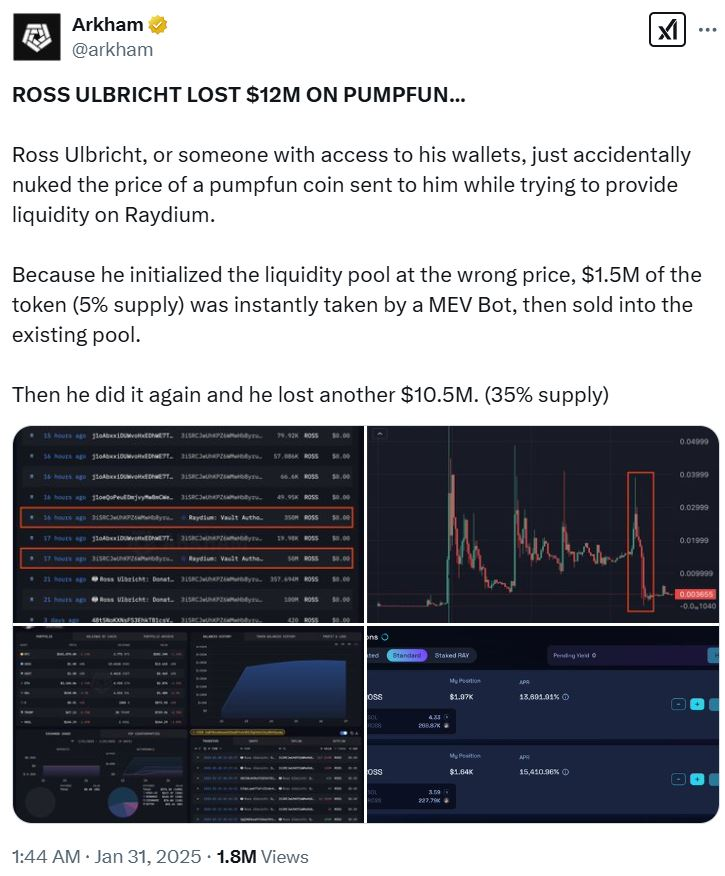

Ulbricht, or someone operating his wallets after his release, was attempting to add liquidity to the ROSS token, a memecoin that was created after Ulbricht’s release from prison. The idea was to help stabilize the token’s price by providing liquidity. But instead of setting the price correctly, the liquidity pool was initialized at the wrong price — a simple yet costly mistake.

This mispricing set off a chain reaction: an MEV (Maximal Extractable Value) bot, which scans for profitable opportunities in real-time, immediately jumped on the mispriced tokens. The bot scooped up $1.5 million worth of the token (about 5% of the total supply) before anyone could react. It then sold those tokens back into the existing pool, pocketing a profit, while driving the token’s price into the ground.

Arkham explained that the bot “nuked” the price of ROSS, creating an opportunity for others to make quick profits at the expense of the liquidity provider. But this wasn’t the end of it — the same wallet went on to repeat the mistake, losing another $10.5 million, or roughly 35% of the total supply.

The $10.5 Million Second Blunder: A Double Hit

Here’s where things got even worse: the wallet operator tried again. This time, they attempted to add single-sided liquidity to sell off the coins more passively. But the same error happened again — the wrong type of liquidity pool was used. Instead of the CLMM (Concentrated Liquidity Market Maker), they accidentally created a CPMM (Constant-Product Market Maker) pool.

This set up an even bigger opportunity for the MEV bot, which took advantage of the mispricing once again, selling off the tokens for a quick profit of over $600,000. As a result, the value of ROSS plummeted by 90%.

If that wasn’t bad enough, ROSS ended up trading at just around 1 cent, despite a brief 700% price surge in the last 24 hours, according to DEX Screener. Talk about volatile!

The Silver Lining: Still Holding Significant Token Supply

Despite the significant losses, there’s still a bright spot for the wallets involved. After losing 40% of the supply, the wallets tied to Ulbricht’s address still hold about 10% of the total supply of ROSS, which is worth around $200,000. Not quite the $12 million they lost, but it’s something.

Interestingly, both of the flagged wallet addresses are linked to FreeRoss.org, a campaign run by Ulbricht’s family to raise funds for his legal battle and eventual release from prison. Ulbricht’s Solana donation address actually received 50% of the initial supply of ROSS from the developer, meaning a portion of the funds lost from the blunder could still go toward supporting the cause.

Who Is Ross Ulbricht? A Quick Recap

If you’re wondering who Ross Ulbricht is and why this story matters, here’s a quick recap: Ulbricht was the mastermind behind the Silk Road, an infamous online black market that allowed people to buy and sell illegal goods using Bitcoin as payment. His site was shut down by the FBI in 2013, and Ulbricht was arrested, sentenced to double life in prison plus 40 years, without the possibility of parole.

Ulbricht’s case has been a rallying cry for many in the crypto world, who argue that his sentence was overly harsh. On January 22, 2025, President Trump granted him a pardon, fulfilling one of his campaign promises to make changes to the U.S. criminal justice system, especially concerning cases involving cryptocurrency.

A Cautionary Tale: The Risk of Crypto

While this story may seem like a tale of missed opportunities and bot-driven chaos, it also serves as a cautionary reminder of the risks involved in the cryptocurrency world. Whether you’re a seasoned investor or a newcomer trying to dip your toes into decentralized finance, mistakes like this can happen — and they can be costly.

In this case, ROSS was a token born out of a desire to support Ulbricht’s cause, but due to a simple pricing error, the wallets tied to Ulbricht’s name took a major hit. It’s a story of human error, algorithmic bots, and the unpredictable nature of the decentralized finance world, all wrapped up in one unfortunate event.

For now, ROSS and the wallets linked to Ulbricht’s campaign continue to navigate this turbulent landscape, but it’s clear that crypto trading — and liquidity provision in particular — requires a lot more than just good intentions. One wrong move, and millions can vanish into the blockchain abyss.