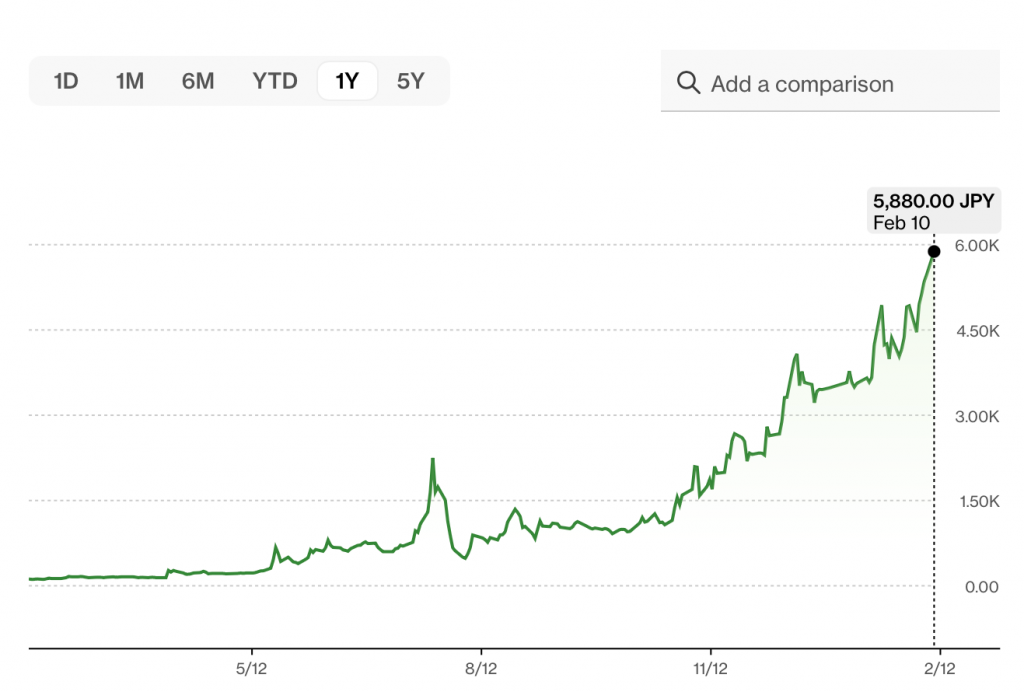

Metaplanet has followed in the footsteps of Bitcoin advocates like MicroStrategy, and the results have been nothing short of explosive. The company’s stock has surged an incredible 4,800% over the past year, thanks to its aggressive Bitcoin strategy.

In what has become one of the most talked-about success stories in the crypto world, Metaplanet, often dubbed “Asia’s MicroStrategy,” has watched its share price soar by a staggering 4,800% in just 12 months. The reason for this astronomical rise? The company’s bold decision to stack Bitcoin (BTC) on its balance sheet.

The Bitcoin Bet: How Metaplanet Followed MicroStrategy’s Playbook

Much like Michael Saylor’s MicroStrategy, which began acquiring Bitcoin in 2020, Metaplanet has embraced the digital currency as a strategic asset, and it’s paying off in spades. The company officially announced its Bitcoin treasury strategy in April 2024, and since then, its stock has seen an unprecedented jump.

As of February 10, Metaplanet’s shares have surged by 4,800%, according to Bloomberg data. The company has already accumulated 1,762 BTC, worth around $171 million as of January 28, and has plans to expand its holdings significantly in the coming years. By 2026, Metaplanet aims to own up to 21,000 BTC—an amount that would represent approximately 1/1,000th of all the Bitcoin that will ever exist.

With Bitcoin firmly at the center of its strategy, Metaplanet recently reported its first operating profit in seven years, marking a major milestone for the company and proving that its unconventional approach is paying off.

The Rise of the Bitcoin Treasuries

Metaplanet isn’t alone in this Bitcoin-accumulating strategy. It has closely followed the example set by MicroStrategy, whose decision to make Bitcoin a core part of its corporate treasury strategy since August 2020 has resulted in massive growth. As of today, MicroStrategy’s stock has surged from a modest $13.49 per share to an impressive $332.60—a dramatic increase fueled by its Bitcoin purchases.

Other companies have also adopted similar strategies, though the results have been mixed. Some have seen their stock prices climb, while others have struggled to generate sustained enthusiasm in the market. Regardless, the overall trend of holding Bitcoin as part of a company’s financial strategy is gaining momentum.

Metaplanet’s Explosive Growth: 500% Jump in Shareholders

Metaplanet’s decision to add Bitcoin to its balance sheet seems to have struck a chord with investors. According to a recent presentation, the company’s shareholder base grew by an eye-popping 500% in 2024, with 50,000 new individuals or entities buying into the company. Metaplanet’s market capitalization also saw a jaw-dropping increase of over 6,300% during the same period, according to Stock Analysis data.

These numbers reflect a broader shift in how investors are viewing Bitcoin. Once considered a risky asset, Bitcoin is increasingly being seen as a hedge against inflation and a viable alternative to holding cash. This is especially true as more traditional companies and even governments are starting to consider Bitcoin as part of their financial reserves.

Bitcoin as a Hedge: A Growing Trend in Corporate Strategy

Bitcoin’s rise in popularity is not just a tech and crypto trend—it’s becoming a serious alternative for corporations looking to protect themselves against inflation and economic instability. In the U.S., at least 16 states have introduced legislation to start building Bitcoin reserves. Countries like the U.S. and the Czech Republic are also exploring Bitcoin as a potential reserve asset.

As the world increasingly turns its attention to Bitcoin’s potential as a store of value, companies like Metaplanet are reaping the rewards. And the trend is gaining steam. Currently, at least 32 publicly traded companies hold Bitcoin on their balance sheets, including both crypto-native businesses like miners and traditional corporations who see the potential in digital assets.

Bitcoin’s Surge: 133% Rise in 52 Weeks

Bitcoin itself has also enjoyed a significant rise in the past year, up 133% in the last 52 weeks, fueled in part by the growing number of companies adopting Bitcoin as a treasury asset. This surge has helped solidify Bitcoin’s position as the dominant cryptocurrency in the market, with a 60.5% market dominance as of February 2025. This represents a marked increase from its market dominance of 38% in December 2022, and analysts predict that the trend will continue as more businesses and institutional players get involved.

The Future of Metaplanet and Bitcoin Treasuries

With Metaplanet setting ambitious goals for its Bitcoin acquisition strategy, it’s clear that the company is doubling down on its belief in the digital asset’s long-term value. If the company successfully reaches its goal of acquiring 21,000 BTC, it would not only own a substantial amount of Bitcoin but also place itself at the forefront of a growing movement of companies integrating cryptocurrency into their core business models.

Metaplanet’s rapid growth is a testament to the increasing mainstream adoption of Bitcoin and the evolving role of digital assets in traditional financial strategies. As more companies follow suit and integrate Bitcoin into their treasuries, we could see a significant shift in the way both the corporate world and financial markets operate in the coming years.

Metaplanet’s success story shows that when it comes to Bitcoin, fortune favors the bold—and it seems this company’s boldness is paying off big time.