So, hold onto your hats, folks! According to the latest jaw-dropping report from VanEck, Bitcoin might just become the world’s most luxurious digital bling. They’re projecting that by 2050, Bitcoin could be worth a staggering $2.9 million per coin. Yes, you read that right—MILLION. That’s like buying a private island, but way more digital.

The Bitcoin Gold Rush: How Did We Get Here?

VanEck, the financial wizards who seem to have a crystal ball for crypto, are envisioning a future where Bitcoin’s total market capitalization soars to a whopping $61 trillion. That’s trillion with a “T.” They think Bitcoin will become the go-to choice for settling trade deals and a reserve currency for central banks. Imagine central banks casually holding 2.5% of their assets in BTC like it’s their favorite collectible toy.

In their vision of the future, Bitcoin might be used to settle a massive 10% of international trade and 5% of domestic trade. It’s like Bitcoin becomes the new kid on the global trade block, showing up with a “cooler than thou” attitude and stealing the spotlight from the old-school currencies.

The Layer 2 Explosion: More Than Just Crypto Sidekicks

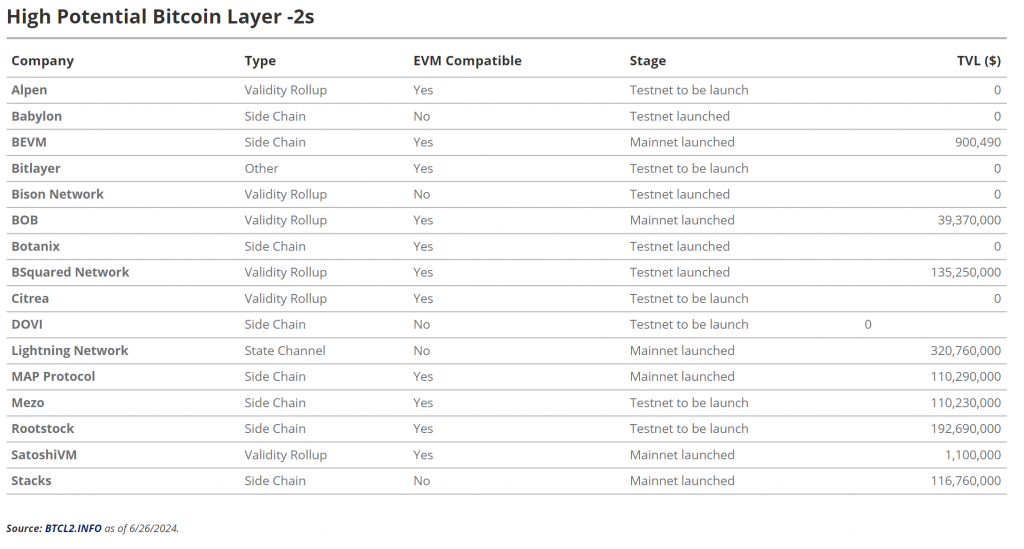

And let’s not forget about Bitcoin’s sidekicks—Layer 2 solutions (L2s). VanEck predicts these could collectively be worth around $7.6 trillion by the time we’re sipping virtual martinis in 2050. That’s approximately 12% of Bitcoin’s total value, which sounds like a pretty sweet deal for tech enthusiasts and digital finance geeks.

VanEck’s report assures us that Bitcoin’s scaling issues—those annoying little speed bumps on the road to mainstream adoption—will be smoothed out by these upcoming L2 solutions. They’re confident that these fixes will turn Bitcoin from a cool tech curiosity into a must-have global phenomenon.

The Decline of Fiat: Bitcoin to the Rescue?

Now, if you’re worried that this Bitcoin utopia might just be a fantasy, VanEck’s got some backup. They predict that Bitcoin’s rise will coincide with a fall from grace for the world’s biggest economies. With the U.S., the EU, and Japan possibly losing their economic mojo and confidence in their currencies plummeting due to wild deficit spending, Bitcoin might step in as the savior.

In this shaky economic landscape, businesses and consumers might start to see fiat currencies as the flawed, unreliable ex they should have dumped years ago. Enter Bitcoin: the neutral, immutable superhero with predictable monetary policies that no one can mess with.

VanEck points out that the euro and yen are already showing signs of weakness. The euro’s share of cross-border payments has dropped from 22% in the mid-2000s to a mere 14.5% today. Meanwhile, the yen’s share has slunk from 6.2% to 5.4%. This shrinking role could pave the way for Bitcoin to swoop in and take over.

Bitcoin’s Bumpy Road: Risks and Gold’s Old Glory

Of course, it’s not all sunshine and rainbows. VanEck acknowledges that Bitcoin’s journey will face some hurdles, like mining issues, scalability concerns, and regulatory red tape. They also admit that while gold has been a reliable global reserve asset, its logistics and security problems make a return to the gold standard look like a non-starter.

So, while gold may be the classic choice for your grandparent’s investment portfolio, Bitcoin is gearing up to be the high-tech, futuristic alternative that might just save the day.

Betting on Bitcoin’s L2 Future

VanEck isn’t ready to crown the Bitcoin L2 champions just yet, but they’ve got their eyes on 16 promising projects like Lightning Network and Stacks. Who knows? One of these might just become the Batman to Bitcoin’s Bruce Wayne.

So, buckle up, crypto enthusiasts. The future is looking bright—and incredibly valuable—for Bitcoin. Start saving up for that future crypto millionaire lifestyle, and maybe keep a few L2s on your radar. After all, in the world of digital currencies, anything can happen!