Behind the Death of Diem: A Battle Against Political Pressure

The rise and fall of Meta’s Diem stablecoin project, once hailed as a revolutionary plan to reshape global payments, is a tale of political intrigue, regulatory battles, and corporate ambition. According to David Marcus, the former head of Diem (formerly Libra), the project didn’t fail because of technical flaws or legal barriers. Instead, it was a victim of political pressure, orchestrated by U.S. regulators who were determined to crush the initiative.

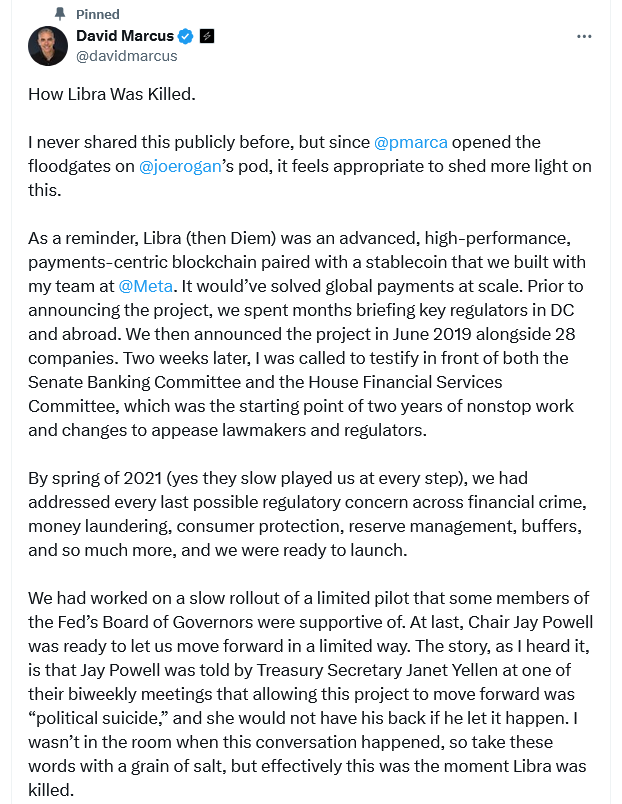

In a series of explosive statements on November 30, 2023, Marcus claimed that the project’s demise was not a result of regulatory hurdles but rather a “100% political kill,” carried out through the intimidation of banks and high-level political interference. According to Marcus, despite the project clearing most legal and regulatory hurdles, the U.S. Treasury Secretary and the Federal Reserve were behind its eventual termination.

From Ambition to Collapse: Diem’s Vision and Setbacks

Launched in June 2019, Meta’s Diem (formerly Libra) was envisioned as a global decentralized payments network that would be powered by a U.S. dollar-backed stablecoin. The goal was ambitious: to enable fast, secure, and low-cost global payments at scale, connecting people across borders and financial systems. Meta had the support of some major players in the financial world, including Visa and PayPal, both of which Marcus had close ties to as their former president.

At the time, Diem seemed poised to revolutionize global finance. Marcus himself believed the project could’ve transformed the payments industry, saying, “It would’ve solved global payments at scale.” However, the ambitious project immediately encountered resistance from regulators and lawmakers who were skeptical of Meta’s ability to create a digital currency without posing risks to financial stability.

A Growing Storm: Political Interference from Washington

The initial excitement surrounding Diem was short-lived, as the project soon became a lightning rod for political backlash. Within two weeks of its announcement, Marcus found himself testifying before both the Senate Banking Committee and the House Financial Services Committee, where he faced questions about everything from money laundering to consumer protection concerns.

Marcus recalls that from that moment on, the team was constantly racing to appease lawmakers and regulators, making changes to the project in a bid to address various concerns. Despite these efforts, the political pressure continued to escalate.

At one point, Jerome Powell, the Chairman of the Federal Reserve, reportedly indicated that he was open to allowing the project to proceed, albeit in a “limited way.” However, that hope was dashed when Janet Yellen, the U.S. Treasury Secretary, allegedly told Powell that supporting Diem’s development would be “political suicide.” Marcus claims that Yellen’s opposition was the decisive blow, preventing the project from advancing any further.

The Final Nail in the Coffin: Banks Pressure

But the political pressures didn’t stop there. The real death blow for Diem came when the Federal Reserve allegedly communicated to several key banks that they were “not comfortable” with participating in the project. This meant that without banking partners on board, the entire project could not move forward.

In early 2022, Meta decided to cut its losses and abandoned Diem, selling its intellectual property and assets to Silvergate Capital—a deal that ultimately led to Silvergate’s bankruptcy in 2023. For Marcus, this was the end of a once-promising initiative, and it left him reflecting on the broader implications for the future of digital currencies and financial systems.

Why Diem Failed: Marcus Reflects on the Bigger Picture

Marcus shared his thoughts on the failure of Diem, emphasizing a key lesson learned from the collapse: If you want to create a truly global and decentralized payment system that can move trillions of dollars a day and stand the test of time, you need to build it on an open, neutral network—something that, in his view, Bitcoin embodies.

In Marcus’s words, “If you’re trying to build an open money grid for the world, designed to be here 100 years from now, you have to build it on the most neutral, decentralized, unassailable network and asset.” He made it clear that for him, Bitcoin represents the best solution for building a global monetary system that isn’t subject to the whims of political pressure or centralized control.

The Political Kill: Implications for the Future of Stablecoins and Digital Currencies

Marcus’s comments shed light on how deeply political dynamics can shape the development of financial technologies—especially those that challenge the status quo. Diem’s ambitious vision for a global digital currency might have been too much for some regulators to handle, especially in an era of heightened scrutiny over privacy, sovereignty, and centralized power in the financial system.

The story of Diem’s downfall raises important questions about the future of stablecoins and digital currencies. Government-backed digital currencies (CBDCs) have gained traction in recent years, and some industry insiders fear that initiatives like Diem could pose a threat to traditional monetary systems controlled by central banks. With Bitcoin and other decentralized currencies still operating outside of the regulatory framework, there’s growing tension between innovation and regulation in the crypto space.

Ultimately, the Diem project represents an ambitious attempt to rethink global finance, but it also highlights the significant political obstacles that innovators in the financial tech space face. Whether the world will eventually embrace decentralized digital currencies or if regulators will continue to clamp down on such projects remains to be seen. What is clear, however, is that the political forces at play in the Diem saga may be a glimpse into the ongoing battle over the future of money.

For now, Diem is dead, but the debate over the future of money—decentralized or centralized?—is far from over.