The Japanese firm is betting big on Bitcoin, and it’s paying off—here’s why they’re pivoting even further into the crypto world.

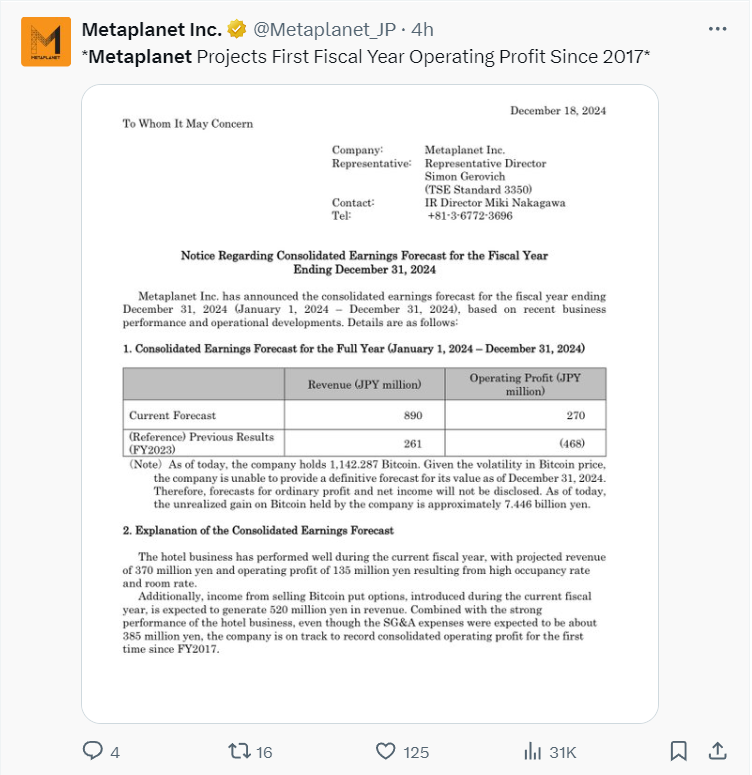

Metaplanet, the Tokyo-based investment firm that made headlines for pivoting toward Bitcoin, has just reached a major milestone: the company is set to record its first operating profit in seven years—and it’s all thanks to Bitcoin (yes, that Bitcoin). After a rocky financial history, the firm is now projecting a revenue of ¥890 million ($5.8 million) for the fiscal year ending December 31, up from just ¥261 million last year. What’s more impressive? A turnaround from a loss of ¥468 million to an operating profit of ¥270 million.

So, what’s the secret sauce behind this financial glow-up? Spoiler alert: it’s not just Bitcoin on the balance sheet.

The Bitcoin Bet Pays Off

Metaplanet’s pivot into Bitcoin didn’t just stop at adding BTC to its treasury. In fact, a major chunk of its impressive revenue for this fiscal year came from selling Bitcoin put options. These contracts helped the firm bring in a whopping ¥520 million. For those who are a bit fuzzy on the concept, put options are essentially bets on the value of Bitcoin dropping. If the value does drop, Metaplanet profits when buyers exercise their option to sell at a fixed price. But even if the option isn’t exercised, the firm still rakes in a premium for selling the contract. Not a bad gig if you ask us.

Expanding Beyond the Basics

But Metaplanet isn’t just a Bitcoin accumulator. The firm wants to go full throttle with a comprehensive Bitcoin strategy. In a recent investor update, Metaplanet revealed it would formalize “Bitcoin accumulation and management” as its own business line, which would involve using everything from loans to convertible bonds to buy and hold even more Bitcoin. With this move, Metaplanet plans to use put options as its primary revenue engine while also exploring new ways to monetize Bitcoin itself.

The company’s ambition doesn’t stop there. It has already launched Bitcoin-related marketing initiatives, like the newly acquired license to run the Japanese version of Bitcoin Magazine—a strategic move aimed at monetizing the growing interest in Bitcoin education and media.

Metaplanet’s Bold Bitcoin Holdings Strategy

As of now, Metaplanet holds 1,142 Bitcoin, valued at approximately $119.4 million. This positions the company as Asia’s second-largest corporate Bitcoin holder, only behind Boyaa Interactive. But they’re not stopping there. On December 16, Metaplanet announced a fourth bond issuance worth nearly ¥4.5 billion ($30 million), all in an effort to accumulate more Bitcoin. And there’s more on the horizon—Metaplanet plans to issue another ¥5 billion in private bonds to further boost its BTC stash.

A Rising Star in Both Crypto and Traditional Business

What’s really setting Metaplanet apart is how it’s combining its traditional business operations with the booming world of crypto. The firm has also been seeing strong performance from its Royal Oak Hotel in Tokyo’s Gotanda district, which is boosting its overall financial health. By diversifying its strategy and not putting all its eggs in the Bitcoin basket, Metaplanet is demonstrating that it’s not just a one-trick pony.

As Metaplanet pushes into new crypto territories, they’re setting a model for other traditional firms looking to hedge against inflation and currency depreciation. In fact, the firm’s decision to adopt Bitcoin as a treasury asset back in April 2024 marked a major milestone in Japan’s corporate crypto adoption.

Looking Ahead: More Bitcoin and Bigger Gains

As Bitcoin continues to climb and gain acceptance in the corporate world, Metaplanet’s strategy appears to be a winning one. The firm’s blend of traditional asset management with cutting-edge crypto operations gives it a unique edge in both industries. If the firm’s projections hold true, Metaplanet could soon be the poster child for successful corporate Bitcoin integration.

So, will this strategy continue to pay off? With Metaplanet on track to hit a first operating profit in seven years, it’s safe to say that this Tokyo-based firm is making bold moves in both the crypto world and the business world at large. Who knows—other firms might soon be looking to Metaplanet for a blueprint on how to ride the Bitcoin wave.

In conclusion: Metaplanet’s profit surge proves one thing—it’s not just about holding Bitcoin. It’s about using Bitcoin to drive diverse revenue streams, engage in innovative financial strategies, and open up new avenues for growth. Here’s to the future of finance… and Bitcoin.