Subtitle: Bitcoin’s $100K Struggle and Predictions for 2025 Amid Stagnant ETF Flows

Bitcoin (BTC) has been stuck in a frustrating holding pattern just below the $100,000 mark since mid-December. After reaching an all-time high of over $108,000 in mid-December, it’s been drifting downwards, currently hovering around $95,737, about 9.7% off its peak. However, while Bitcoin may be facing a temporary downturn due to holiday trading slumps, analysts remain bullish on its long-term prospects. Many believe a strong recovery above the $100,000 threshold is just around the corner, with some predicting a rally toward $105,000 as liquidity returns after the Christmas holiday lull.

Holiday Lull or a Bigger Trend?

Ryan Lee, chief analyst at Bitget Research, offers an optimistic outlook for Bitcoin in the coming weeks, pointing out that the current dip is largely a result of the typical holiday-induced illiquidity in the market. According to Lee, market activity typically picks up again post-Christmas as traders return to the markets and funds position themselves ahead of major events—most notably, the upcoming inauguration of Donald Trump on January 20, 2025.

Lee believes that this political event could trigger positive macroeconomic shifts, including a more favorable regulatory environment for cryptocurrencies in the U.S. This, combined with the usual uptick in market activity after the holidays, could push Bitcoin’s price back into the $94,000 to $105,000 range for the remainder of the year.

Looking Beyond the Holidays: Macro Trends Favor Bitcoin

As Bitcoin continues to consolidate its position below $100,000, analysts are keeping their eyes on the broader macroeconomic trends. Many expect a resurgence in institutional interest and bullish market conditions to fuel a price rally into the first quarter of 2025. In particular, the anticipation of Trump’s inauguration and the resulting potential policy changes in the U.S. are adding a layer of optimism to Bitcoin’s prospects.

In fact, some analysts are forecasting that Bitcoin could see a significant upward trajectory over the next year, with some even predicting that it could break the $160,000 mark by 2025, especially if macro conditions improve and the regulatory landscape becomes more favorable.

Bitcoin ETFs: A Roadblock for Now

Despite the positive macro outlook, Bitcoin’s journey to higher levels has been significantly impacted by the recent slump in U.S. spot Bitcoin exchange-traded funds (ETFs). For much of 2024, Bitcoin ETFs were a driving force behind the cryptocurrency’s rally, particularly the U.S. spot ETFs, which accounted for around 75% of new investments. These inflows helped propel Bitcoin above $50,000 in February 2024, and continued institutional buying was expected to push it past the $100,000 mark.

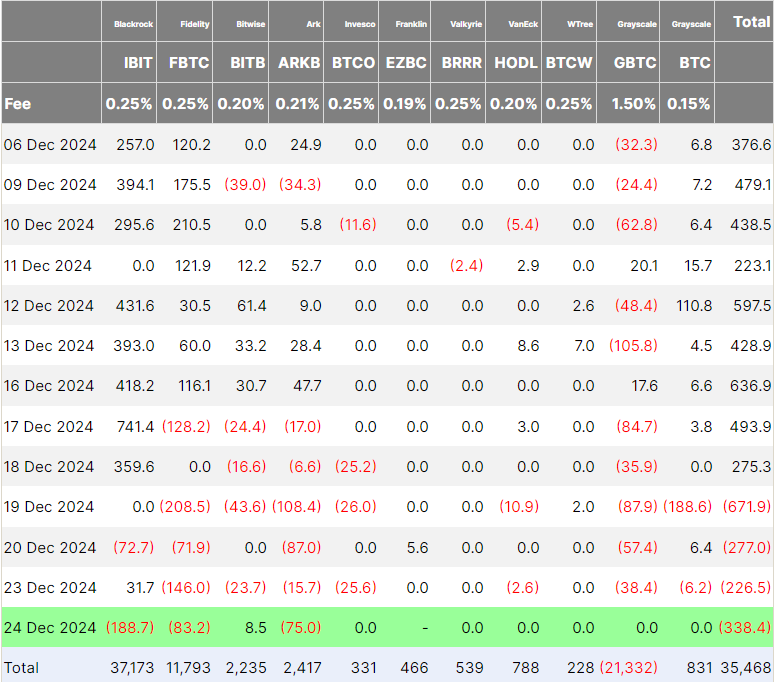

However, as of late December, Bitcoin ETFs have been experiencing a significant drain. Data from Farside Investors reveals that Bitcoin ETFs suffered a four-day losing streak, recording over $338 million in cumulative net outflows by December 24. This reflects a broader trend of waning institutional interest during the holiday season, as many funds reduce their exposure or sit on the sidelines until after the new year.

A Buyer’s Market: Funding Rate Signals Optimism

Despite the ETF setbacks, there are some positive signs in Bitcoin’s market dynamics. One key indicator is the Bitcoin funding rate, which is currently at a positive 0.0100% on Binance, the world’s largest crypto exchange. This funding rate measures the cost of maintaining positions in Bitcoin futures markets and indicates the balance between buyers and sellers. A positive funding rate suggests that buyers are in control, as they are willing to pay sellers to hold their positions, indicating strong demand for Bitcoin in the futures market.

This could signal that the market is ripe for a rebound once liquidity returns and institutional players begin to re-enter the market in early 2025.

Technical Charts Show Mixed Signals

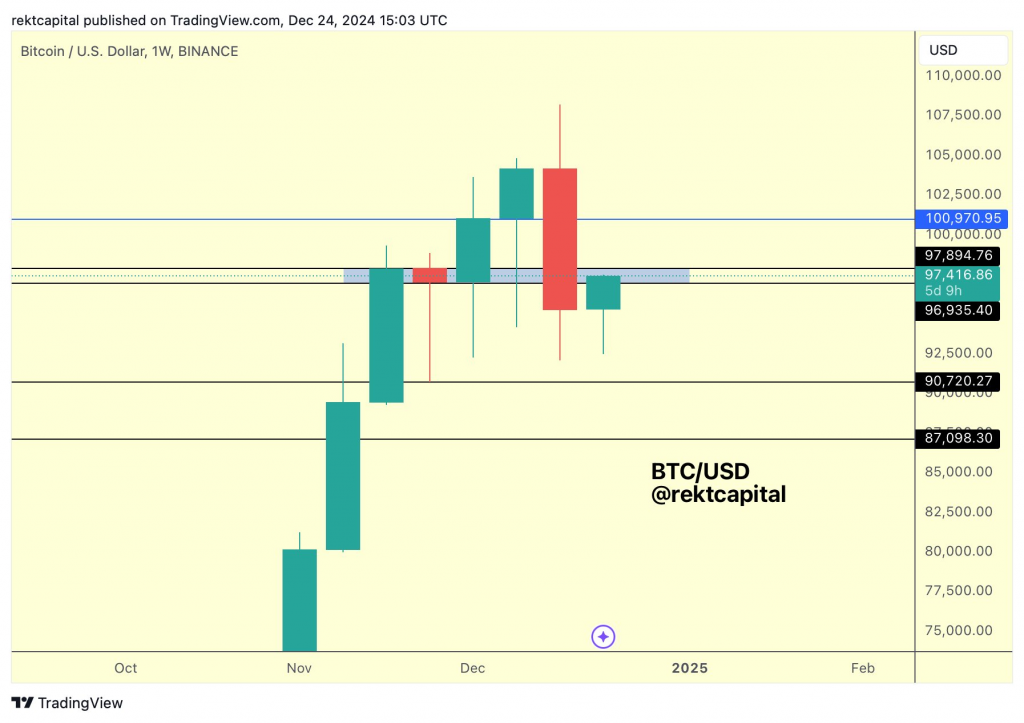

While the fundamental outlook for Bitcoin remains positive, technical indicators tell a slightly different story. Crypto analyst Rekt Capital recently pointed out that Bitcoin’s price showed signs of a relief rally before being rejected back to almost new lows. As long as Bitcoin continues to face resistance at previously lost support levels, analysts predict additional downside in the short term.

For traders watching the charts, this means that while a recovery to $105,000 could still be on the horizon, Bitcoin may need to work through some further consolidation before it can mount a sustainable rally. The overall sentiment remains bullish, but the technical patterns suggest caution in the near term.

Looking to 2025: A Bright Future for Bitcoin

Looking beyond the immediate market turbulence, analysts remain hopeful for Bitcoin’s prospects in 2025. The combination of improving macroeconomic conditions, a potential recovery in ETF flows, and positive developments in cryptocurrency regulation could fuel Bitcoin’s next big rally. According to a report from Matrixport, Bitcoin could reach as high as $160,000 by 2025 if the broader economic environment supports its growth.

As the new year unfolds, investors and traders will be watching closely to see if Bitcoin can recover from its current slump and push towards new all-time highs. Whether it’s through a renewed surge in institutional buying, favorable political and economic shifts, or simply the return of market liquidity post-holidays, Bitcoin’s future remains bright—and analysts are betting on a strong recovery in the months ahead.

In Conclusion: Patience Is Key for Bitcoin Investors

While Bitcoin faces some short-term headwinds, particularly due to ETF outflows and the typical holiday trading slump, analysts are largely optimistic about its long-term trajectory. With expectations for a rally above $100,000 and even higher predictions for 2025, Bitcoin investors will likely have to exercise patience in the coming weeks as the market digests the current lull. Once liquidity returns, and with macroeconomic trends favoring the cryptocurrency sector, Bitcoin could soon be back on track toward reclaiming new heights.