The lines between traditional finance (TradFi) and decentralized finance (DeFi) are blurring faster than ever, and a major partnership between Pyth Network and Revolut is helping to accelerate this trend. On January 8, 2025, Pyth, a decentralized data infrastructure provider, announced its collaboration with the fintech giant Revolut to bring real-time digital asset data into the decentralized finance ecosystem. This partnership marks a pivotal step in bridging the gap between traditional financial institutions and the emerging Web3 space.

Integrating Digital Asset Data into DeFi

Under the terms of the partnership, Revolut will share its proprietary digital asset price data through the Pyth Price Feeds, making it accessible to developers in the DeFi space. This data will provide valuable “quote and trade” information, which DeFi platforms can use to power a wide range of decentralized applications (DApps).

For Revolut, the move represents a deeper integration into the decentralized finance ecosystem, allowing the company to contribute its data to enhance the security and functionality of Pyth’s decentralized applications. This collaboration will help to further stabilize the emerging Web3 market by providing reliable and real-time pricing data for digital assets, which is a crucial element for DApps to operate effectively.

DeFi and TradFi: The Future of a Global Financial Market

Mike Cahill, CEO of Douro Labs and a core contributor to the Pyth Network, spoke about the significance of this partnership, stating that it’s “proof that the lines between traditional finance and Web3 are disappearing once and for all.” This partnership signals a broader shift toward collaboration between TradFi and DeFi, and according to Cahill, this fusion is essential for creating a truly global financial market.

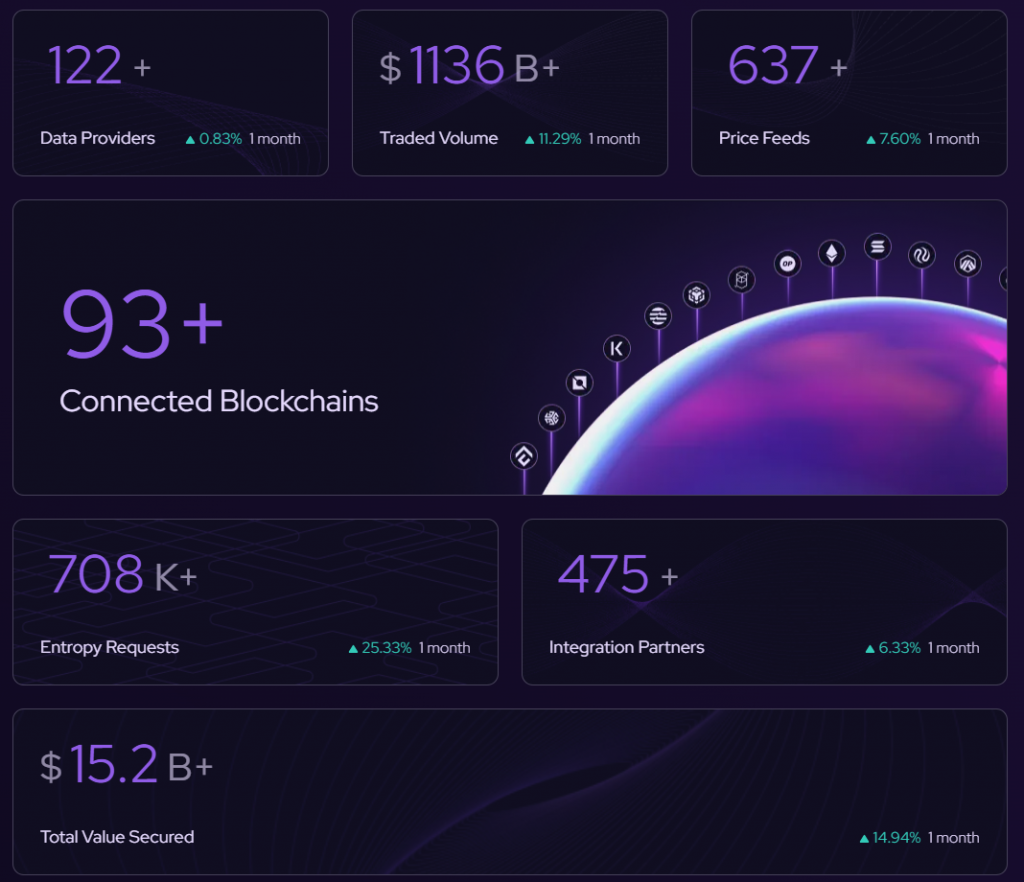

The integration will give DeFi developers access to over 500 real-time feeds across a wide range of assets—including digital assets, foreign exchange, equities, and commodities. These feeds are critical for powering the DApps that have seen explosive growth, with the total traded volume on Pyth-powered DApps surpassing $1 trillion in 2024. This partnership is poised to expand as Revolut continues to expand its crypto services, particularly through its Revolut X platform across the European Economic Area.

For Revolut, this move is part of its ongoing commitment to expand its cryptocurrency offerings. The company described this partnership as a “natural progression” in its evolution toward bridging the traditional financial world with the decentralized future of finance.

The Growing Competition: Pyth vs. Chainlink

While Pyth and Chainlink are both known for providing price feeds in the DeFi space, Pyth’s recent developments and expansion into real-time data feeds have sparked conversations about competition. However, Cahill isn’t focused on that. In an exclusive interview, he explained that Pyth Network’s primary goal is not to simply outperform Chainlink but to accelerate the shift from TradFi to DeFi.

“Pyth flipped Chainlink in Total Transaction Volume a long time ago, and honestly, we haven’t thought about them since,” Cahill said, showing that the Pyth team is more focused on its broader mission. “Our mission is to empower developers to build DApps that can compete with traditional financial applications, not just be the top oracle.”

The decentralization and transparency of price data have become core components of the DeFi ecosystem. Cahill emphasized that in today’s interconnected world, reliable, real-time price feeds are no longer a luxury but a necessity for the security and scalability of decentralized platforms. As DeFi continues to evolve, the demand for trustworthy data will only increase.

A Milestone for Pyth: VanEck’s Pyth ETN Listing

Pyth’s progress doesn’t stop at its partnership with Revolut. In November 2024, the network saw another major milestone when asset management firm VanEck listed an Exchange-Traded Note (ETN) in Europe that tracks the performance of Pyth’s native token. The VanEck Pyth ETN is available to investors across 15 EU countries, including Germany, France, and Switzerland. This listing is significant because it provides institutional investors with a way to gain exposure to Pyth’s performance and the broader Web3 ecosystem in a traditional investment vehicle.

The ETN is fully collateralized by physical PYTH tokens, which are held by Bank Frick, a custodian based in Liechtenstein. This development further solidifies Pyth’s role as a key player in the future of financial data infrastructure and marks a major step toward bringing decentralized finance into the mainstream investment space.

What Does This Mean for the Future of DeFi?

The Pyth-Revolut partnership is a clear signal that the future of finance is becoming more interconnected. Real-time, accurate data feeds are critical for DeFi platforms to function reliably, and with more traditional financial institutions like Revolut contributing their data, the boundaries between traditional finance and Web3 are becoming increasingly porous. This partnership is part of a much larger movement that aims to merge the stability and liquidity of traditional finance with the innovation and decentralization of Web3.

As Revolut expands its crypto offerings and Pyth continues to grow its decentralized data infrastructure, we’re likely to see more institutional players entering the DeFi space, bringing with them not just data but also liquidity, scalability, and regulatory support. In the long run, this collaboration could help DeFi achieve the scale and reliability needed to rival the legacy financial system.

In the coming months and years, the Pyth Network could become an even more integral part of the crypto ecosystem, helping to foster the kind of seamless, real-time data exchange needed to build the next generation of financial applications. The revolution is happening, and it’s happening right at the intersection of TradFi and DeFi.