The Banana Zone: What’s Next for Crypto?

Crypto markets are buzzing with excitement as we head into what some are calling the “Banana Singularity” — a phase where everything goes up. Yes, you read that right. According to Raoul Pal, the CEO of Real Vision and macro investor extraordinaire, the crypto market is in the midst of an incredible bull run, and we’ve only just scratched the surface.

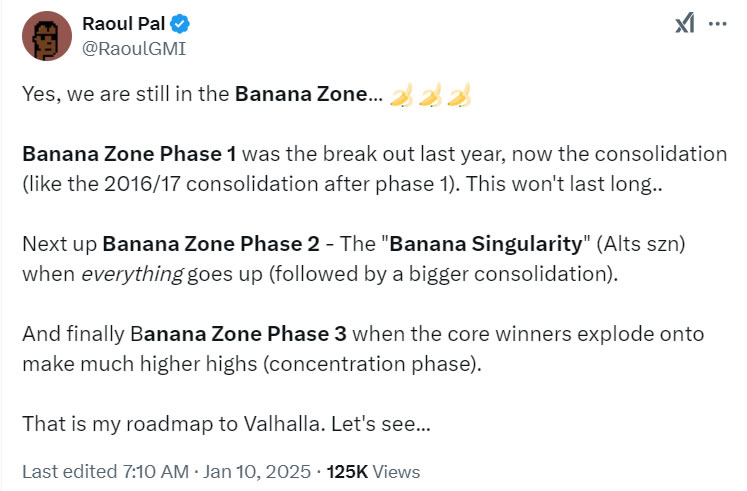

In a series of posts on social media this week, Pal explained the stages of the ongoing crypto cycle, using his now-famous term “Banana Zone” to describe this wild period of upward price movement. For Pal, the Banana Zone is a sign that we’re heading toward a huge shift in the market, one that will see altcoins soar and take the crypto landscape to new heights.

The “Banana Singularity”: A Crypto Frenzy is Coming

Pal’s prediction for the next phase of the market is nothing short of thrilling. He believes we’re about to enter the “Banana Singularity,” which he describes as a time when everything — yes, everything — in the crypto space will go up. This “altcoin season” will be a wild ride where tokens of all shapes and sizes experience massive rallies, followed by a “bigger consolidation” phase.

It’s a classic cycle for crypto markets: a period of intense growth (think: altseason), followed by a correction to bring things back down to earth before the next rally begins. And according to Pal, this exciting altcoin season is just around the corner.

“Yeah, we’re still in the Banana Zone,” Pal said on January 10. The first phase of this bull market began with the breakout last November, and now we’re in the consolidation stage, much like the 2016/2017 cycle. However, Pal assures us that this phase won’t last long. In fact, he predicts that the next phase of the Banana Zone — the Singularity — is about to explode.

Altcoin Mania and Bitcoin Dominance

Historically, altcoin seasons often follow a decline in Bitcoin dominance. Right now, Bitcoin dominance stands at around 58%, which means Bitcoin still holds a significant portion of the market cap, but it’s likely to decline as the altcoin rally picks up speed.

Some analysts, like 0xNobler, are even more bullish than Pal. With a following of over 225,000 on X, 0xNobler shared his prediction that Bitcoin is entering an “acceleration phase” and could reach a whopping $500,000, sparking “the biggest altseason in history.” This prediction has crypto Twitter buzzing, with many hopeful for massive gains across the board.

However, not everyone shares this level of enthusiasm. CoinMamba, a futures trader, struck a more cautious note, suggesting that we may see an altcoin season simply as a result of prices recovering to their levels from just a week ago. So, while the future looks promising, some volatility remains in play.

The “Concentration Phase” Is Next

After the frenzy of the altcoin season, Pal believes we’ll enter what he calls the “concentration phase.” This is when the real winners — the dominant projects with staying power — will explode, reaching much higher highs. This phase is typically marked by larger consolidation as investors pick their favorites and start focusing on the big winners for the long haul.

Despite the market correction this week, crypto markets are still in a strong position. Total market capitalization has climbed a staggering 90% year-on-year, jumping from around $1.8 trillion to a current level of $3.4 trillion. At its peak in December 2024, the market reached an all-time high of $3.9 trillion, 27% higher than its previous cycle peak. It’s clear that, even in the face of volatility, crypto markets are on a long-term upward trajectory.

Pal’s Predictions Are Looking Spot-On

Looking back at previous predictions, Pal’s track record has been impressive. Last year, he accurately forecasted that crypto markets would break out in September after spending months in consolidation. As global liquidity increased, Pal predicted, so would crypto — and other markets like the Nasdaq. Now, he’s doubling down on his belief that higher prices are coming, even if we have to endure some short-term corrections.

In fact, Pal recently shared charts showing the correlation between Bitcoin and the global M2 money supply. The charts reveal a striking resemblance to the 2016/2017 market cycle, where Bitcoin dipped before starting its next big climb. Pal isn’t guaranteeing an exact repeat of history, but he’s confident that we’ll see similar patterns play out. “It’s all going to be just fine,” he said, “Maybe a bit lower or maybe it’s done already. Either way, higher over time. Don’t expect an exact repeat but a rhyme. Valhalla waits.”

Bitcoin’s Path to the Banana Zone

The idea of a “Bitcoin Banana Zone” isn’t new. Back in June 2024, Julien Bittel, head of research at Global Macro Investor, predicted a similar trend for Bitcoin. Bittel called it the “boring zone before the Banana Zone,” and suggested that the crypto market was likely to break out after months of sideways trading.

That breakout happened in early November 2024, coinciding with the excitement following Donald Trump’s victory in the US presidential election. Since then, the market has been in the Banana Zone, with crypto markets experiencing significant price movement — although we’re currently seeing a bit of a correction.

As of January 10, Bitcoin was trading at $93,370, down about 9% from its peak earlier in the week, when it briefly surpassed $102,000. This drop may be short-lived, however, as many analysts predict that the next leg up is just around the corner.

Conclusion: The Future of Crypto Looks Bright

Despite recent market fluctuations, Raoul Pal’s “Banana Zone” theory suggests that we’re on the verge of something big in the crypto space. Whether we’re headed for a massive altcoin season or a Bitcoin breakout, the key takeaway is that crypto markets are gearing up for some explosive growth.

As Bitcoin dominance gives way to altcoins and the next phase of consolidation brings in the winners, there’s no doubt that the crypto landscape is evolving. Whether you’re a seasoned investor or a newcomer, it’s clear that the crypto market is poised for some thrilling moments in the coming months. So, buckle up and get ready for the Banana Singularity — it’s going to be a wild ride! 🍌🚀