New Tax Rules Are About to Shake Up Crypto Trading in India—Here’s What You Need to Know

Crypto enthusiasts in India are about to feel the heat as the government rolls out tough new tax regulations that could slap up to a 70% penalty on undisclosed cryptocurrency gains. So, if you’ve been trading crypto in the shadows, it’s time to pay attention. Let’s break down what’s coming and why crypto traders might want to start getting their financial ducks in a row.

A Tax Hammer for Undisclosed Gains: What’s Changing?

India’s Finance Minister Nirmala Sitharaman recently announced some significant updates to the country’s tax laws during the Union Budget 2025. As part of these changes, cryptocurrencies will now fall under the watchful eye of Section 158B of the Income Tax Act, which is designed to target undisclosed income.

In short, if you’ve been trading crypto without reporting your gains, you could soon be facing a serious tax penalty. The new rules will allow tax authorities to conduct block assessments on undisclosed crypto profits. This means that crypto assets—whether it’s Bitcoin, Ethereum, or any other digital token—will now be treated just like traditional assets like cash, jewelry, or gold when it comes to taxation.

The 70% Penalty: What’s at Stake?

Here’s where it gets a bit intense: if you have crypto gains that weren’t disclosed, and you’re caught up in this retroactive audit, you could be hit with a tax penalty of up to 70% of the tax and interest owed. So, if you didn’t report your crypto profits, you could end up paying a huge price.

This penalty applies to undisclosed gains for up to 48 months after the relevant tax year. That’s four years of crypto profits that you might need to account for, with a tax bill potentially growing each year. To put it bluntly, the government isn’t messing around when it comes to enforcing crypto tax compliance.

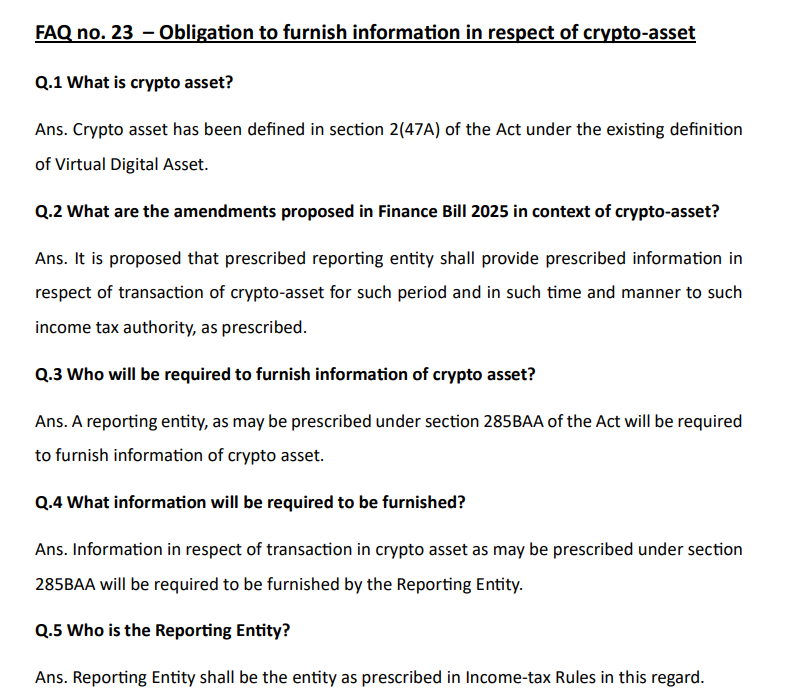

Virtual Digital Assets: What’s Under the Tax Radar?

As part of the new tax framework, crypto assets are officially classified as Virtual Digital Assets (VDAs). The amendment clarifies that any crypto asset falls under this definition, which means that gains from trading crypto will be treated just like the sale of other physical assets. In simple terms, if you bought Bitcoin for a low price and sold it for a high price, that’s taxable income.

If you’re a crypto investor or trader in India, the clock is ticking. Starting February 1, 2025, these new tax rules will be retroactively applicable. So, if you haven’t reported your crypto gains from previous years, you’ll need to prepare for some serious paperwork to catch up with the tax authorities.

Unpaid GST on Crypto: The Government Is Watching

India’s government is also tightening its grip on crypto exchanges. In late 2024, the government discovered that a number of crypto exchanges had failed to pay Goods and Services Tax (GST), with the total amount of unpaid GST reaching 824 crore rupees (roughly $97 million). This came just a few months after authorities demanded 722 crore rupees (about $85 million) from Binance for unpaid taxes.

So, it’s clear that India is keeping a sharp eye on the crypto space, and traders who think they can fly under the radar might want to think again.

What This Means for You: Preparing for the Tax Impact

Crypto traders who haven’t disclosed their gains face a challenging road ahead. Here’s what you need to do:

- Get Your Records in Order: If you’ve been trading crypto for a while and haven’t kept a close eye on your gains, now’s the time to start gathering all your records. Whether it’s trading platforms or wallet transactions, having detailed reports will be crucial for filing accurate tax returns.

- Consult a Tax Expert: With crypto tax laws becoming increasingly complex, it’s a good idea to work with a tax professional who’s well-versed in crypto taxation. They can help you navigate the new rules and ensure you’re not caught off guard.

- Expect a Big Hit: The 70% penalty for undisclosed gains is no small matter. If you’ve been holding back on reporting your crypto assets, you might be facing a significant financial burden if you don’t get ahead of the curve.

Global Crypto Tax Trends: India Is Just One Piece of the Puzzle

India isn’t alone in cracking down on crypto tax evasion. Around the globe, countries are rolling out more stringent regulations to ensure that crypto transactions are properly taxed. For instance, in the United States, new rules from the Internal Revenue Service (IRS) are set to go into effect in 2025, requiring crypto exchanges to report all digital asset transactions to the tax authorities.

It’s becoming clear that governments are tightening their grip on the crypto world, and the pressure is only going to increase as cryptocurrencies continue to gain mainstream adoption.

What’s Next for India’s Crypto Space?

The amendment to India’s tax laws is likely to shake up the country’s crypto scene. With exchanges like Bybit already pulling out due to regulatory pressures, traders might find themselves facing higher barriers to entry and more scrutiny on their transactions. In fact, the uncertainty around crypto regulations might even push more people to decentralized exchanges (DEXs), where regulatory oversight is less stringent—though this could create new challenges for governments trying to track down unpaid taxes.

As for now, the key takeaway for crypto holders in India is clear: be prepared to pay up if you haven’t been fully transparent about your crypto holdings. With penalties this steep, the risk of getting caught in a tax crackdown is far too high to ignore.

In conclusion, while India’s new tax rules are designed to bring more order to the rapidly expanding crypto sector, they also present a massive headache for traders who have yet to fully report their crypto gains. Whether you’re a seasoned investor or just getting started, it’s time to get serious about tax compliance. The government’s new 70% penalty on undisclosed crypto profits is not something you’ll want to ignore.