Bitcoin on the Verge of a Major Price Shift? It looks like Bitcoin might be gearing up for a “decisive price move” in the coming weeks, and the stakes couldn’t be higher. With a mix of macroeconomic developments and the US government’s next move on crypto looming, analysts are eagerly watching to see which way the coin will swing.

The good news? Despite some short-term volatility, the long-term outlook for Bitcoin remains bullish, and many experts predict that a major upward surge could be just around the corner. Let’s break down the charts and see why the next few weeks could be critical for the king of crypto.

Bitcoin’s Stubborn Range: A Sign of Things to Come Bitcoin’s been doing its thing within a fairly tight price range since mid-November 2024, hovering around the $90,000 mark. While some may see this as a period of stagnation, others are reading it as a sign of consolidation before a big move. According to analysts at Bitfinex, Bitcoin’s been trading within a 15% price range, which historically tends to resolve in one direction within 80 to 90 days.

What does that mean for us? If history is any guide, Bitcoin’s price is likely to make a move outside that range soon—whether that’s up or down is still up for debate, but many analysts are leaning toward a positive shift.

The US Government’s Crypto Stance: A Game-Changer? One of the major factors influencing Bitcoin’s potential price movement is the US government’s stance on crypto. Analysts believe Bitcoin still hasn’t fully priced in the US’s pro-crypto policies. As the US government makes more moves to embrace cryptocurrency, Bitcoin could see a major rally in response.

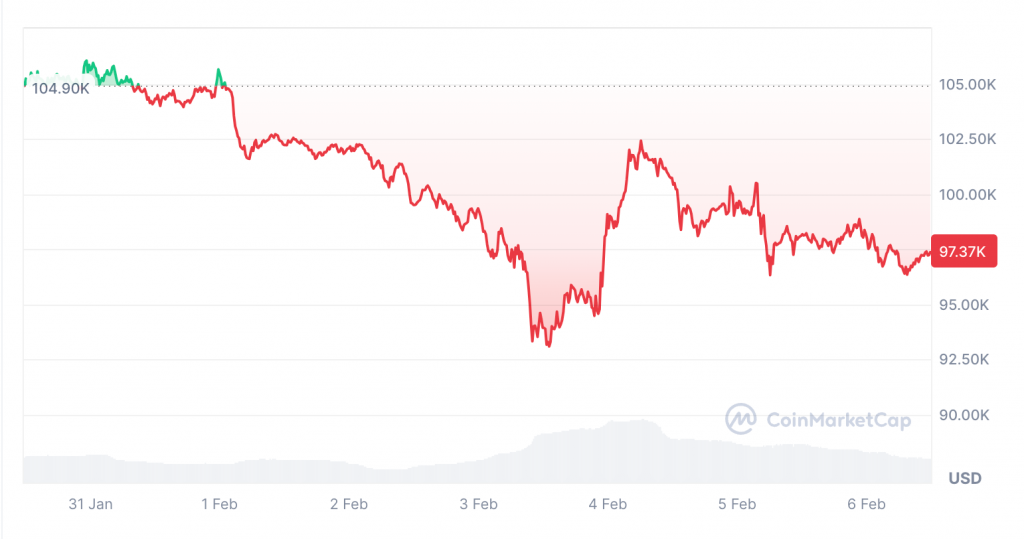

However, it’s not all smooth sailing. Recent developments have shown that Bitcoin remains highly sensitive to macroeconomic events. For example, Bitcoin’s price took a hit when news broke about US President Trump imposing tariffs on Canada, Mexico, and China—leading to one of the largest liquidation events in crypto history. In fact, on February 3, over $2.24 billion worth of crypto was liquidated within just 24 hours.

Bitcoin’s Resilience: Holding Strong Even with all the turbulence, Bitcoin has demonstrated remarkable strength. Despite the market chaos and the tariff news, Bitcoin managed to hold its ground above the psychological $70,000 mark, a price it was hovering around before the US elections. As of the latest reports, Bitcoin’s price briefly dipped below $100,000 to $92,584 before bouncing back to $97,370. While there’s still the potential for short-term shocks, analysts remain optimistic about Bitcoin’s longer-term prospects.

The US Government’s Announcement Could Send Bitcoin Soaring So, what’s the big catalyst everyone is waiting for? The US government’s next move on Bitcoin. Some analysts believe that when the US officially reveals its Bitcoin plans—whether it’s purchasing Bitcoin for reserves or endorsing pro-crypto legislation—Bitcoin could skyrocket. Crypto analyst Thomas Fahrer went as far as predicting that the day the US government announces its Bitcoin plans, Bitcoin’s price could shoot up by $50,000 in a single minute.

This sentiment is shared by MN Capital founder Michaël van de Poppe, who believes that the US is now in a crucial moment when it comes to crypto adoption. According to van de Poppe, Bitcoin is still “neutrally valued” at the moment, while altcoins are “criminally undervalued.” He points out that crypto adoption is bigger than ever, making this the perfect time for the US to finally take the plunge and adopt more crypto-friendly policies.

What’s Next for Bitcoin? With the crypto market buzzing and Bitcoin at the forefront, one thing’s clear: the next few weeks could be a turning point. While short-term volatility is expected—thanks to ongoing macroeconomic conditions and unpredictable market events—Bitcoin’s long-term outlook remains overwhelmingly positive.

The buzz around the US government’s potential Bitcoin buy-in and its broader crypto adoption plans suggests that Bitcoin might be on the verge of a major price surge. As always, the market is unpredictable, but with growing institutional support and a shifting regulatory landscape, Bitcoin could soon break free from its current price range and head into a new bullish phase.

So, buckle up, folks! Whether you’re holding onto your Bitcoin or thinking about entering the market, things are about to get very interesting in the world of cryptocurrency. Stay tuned for what might just be the next big Bitcoin breakout!