Bitcoin is no longer just a rebellious cryptocurrency; it’s becoming a serious contender in the world of finance! Several U.S. states are now considering adopting Bitcoin as a reserve asset, and the buzz around it is only growing. With governments and institutions getting in on the action, this shift could signal the start of a global Bitcoin accumulation frenzy. So, why is everyone talking about it? Let’s dive in.

Kentucky Takes the Lead: A Glimpse into the Future of Bitcoin Reserves

In a bold move, Kentucky has become the 16th state to introduce legislation that could pave the way for the state to hold up to 10% of its excess reserves in Bitcoin. This marks a significant step forward for the cryptocurrency, which is gradually becoming more mainstream. If passed, Kentucky’s new Bitcoin reserve bill might just be the spark that ignites a worldwide race to accumulate Bitcoin.

Isaac Joshua, the CEO of Gems Launchpad, a crypto startup platform, sees this as a key moment in Bitcoin’s journey toward becoming a “mainstream reserve asset.” He believes that if one state successfully integrates Bitcoin into its reserve system, it could pressure others to follow suit. “The tipping point will be when one state formally adopts BTC in reserves. After that, it’s game on,” says Joshua. And he’s probably right. Once a few states commit, the domino effect could force others to jump on board.

The Big Players Are Already in the Game

If you think Bitcoin is still a fringe investment, think again! Some of the biggest asset management firms are already going big on Bitcoin. In fact, through U.S. Bitcoin exchange-traded funds (ETFs), these giants hold over 5.91% of the entire Bitcoin supply—worth a staggering $113.5 billion. BlackRock, one of the world’s largest asset managers, dominates the game, holding over 48.7% of that total.

As more money floods into Bitcoin via ETFs, we could see the price skyrocket. In 2024 alone, U.S. Bitcoin ETFs accounted for 75% of all new BTC investment. With the price recently climbing back above $50,000, the momentum is undeniable. The question is, how long will this bullish trend last?

The Risks: Can Bitcoin Handle the Pressure?

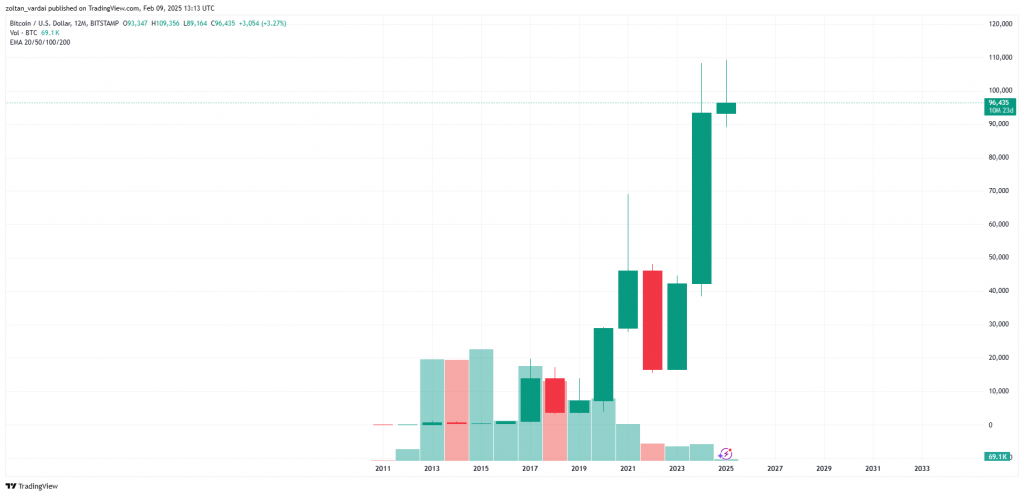

As exciting as this Bitcoin revolution sounds, there are still some bumps in the road. One of the biggest hurdles is volatility. Bitcoin’s wild price swings are hard to ignore. In 2022, for instance, it suffered a 64% drop during the bear market, and it’s seen corrections as steep as 73% in 2018. Ouch.

That said, Bitcoin has proven to be a long-term winner. Over the past five years, it’s delivered a jaw-dropping 1,077% return. This is why some institutions, including the University of Austin, are opting for a minimum five-year holding strategy to ride out the storm and avoid getting caught in the volatility.

The Federal Debate: Bitcoin Reserve for the U.S.?

While many states are hopping on the Bitcoin bandwagon, there are still major regulatory concerns to navigate. James Wo, the founder and CEO of venture capital firm DFG, points out that Bitcoin’s volatile nature and strict fiscal policies might make it a tough sell for some states. Even so, he sees the potential for something bigger down the line: “If enough states pass similar bills, it could lay the groundwork for a broader conversation about a federal Bitcoin reserve in the future.”

Could we see the U.S. government officially adopting Bitcoin as part of its national reserve? Time will tell, but with Kentucky leading the charge, the idea doesn’t seem too far-fetched.

Looking Ahead: More States and More Legislation

The states already involved in Bitcoin reserve legislation include big names like Texas, Florida, Ohio, and Wyoming. And now, Kentucky is stepping up to join the ranks. Each of these states has introduced proposals aiming to incorporate Bitcoin into their financial strategies, with some suggesting that a five-year holding plan would be the best way to minimize risk.

In fact, Illinois has even introduced a Bitcoin reserve bill of its own, with House Bill 1844 suggesting a five-year holding strategy to smooth out Bitcoin’s notoriously choppy ride.

Final Thoughts: Bitcoin’s Time to Shine?

While Bitcoin has faced its fair share of bumps along the way, there’s no denying that it’s gaining serious traction in the financial world. As more U.S. states consider adding Bitcoin to their reserve assets, the path is being paved for a global gold rush (or should we say “Bitcoin rush”?) to accumulate the digital currency.

With major institutions and states leading the charge, Bitcoin is quickly proving it’s not just a speculative asset, but one that could reshape the future of financial reserves. So, buckle up—it looks like Bitcoin is here to stay!